AMD Q1 2025 Earnings Review. Firing On All Cylinders

thus far, AMD is not seeing much in the way of tariff-related impacts to their business

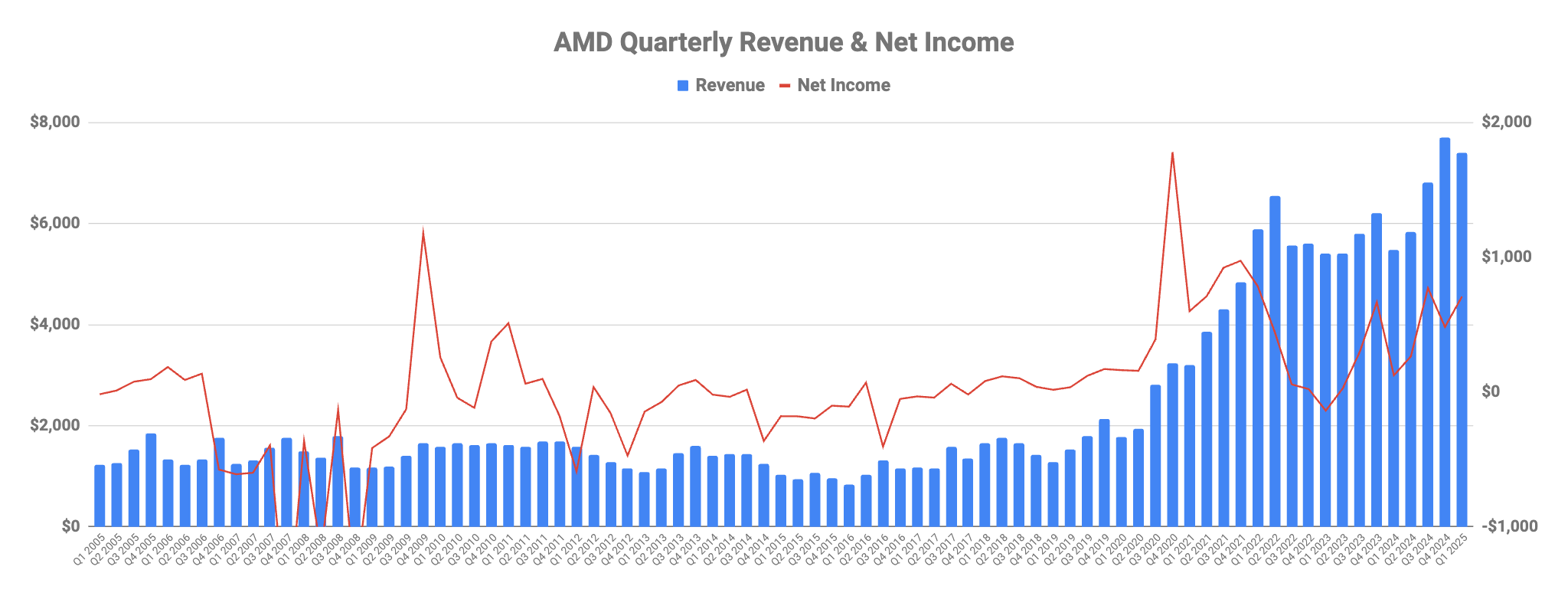

AMD yesterday reported Q1 2025 revenues of $7.4 billion, up 36% YoY, down 3% QoQ and $300 million above the guided midpoint. Non-GAAP Gross margin was 50%, precisely as guided. This marked the company’s fourth consecutive quarter of YoY growth.

Throughout the conference call, CEO Lisa Su painted a convincingly positive picture of the company’s performance thus far this year, and for the year as a whole

Despite the uncertain macroeconomic backdrop, our first quarter performance highlights the strength of our differentiated product portfolio and execution and positions us well for strong growth in 2025.

Looking ahead, AMD forecasted current quarter revenues of $7.4 billion, flat sequentially, together with gross margin of 43% incorporating the impact of an $800 million inventory charge caused by the recent restrictions on leading edge GPU sales to China

This contrasts strongly with Intel’s guide:

As a result, we are forecasting a wider-than-normal Q2 revenue range of $11.2 to $12.4 billion, down 2-12% sequentially

Of particular interest to me was the commentary around their client business. You will recall that just a couple of weeks ago, Intel reported a head-scratching surge in demand for its legacy (>2.5 year old) Raptor Lake client processor

much stronger-than-expected demand for Raptor Lake combined with improved cost for Meteor Lake

On the call, Intel claimed that this surge was driven by client demand. If that were truly the case, then we should have seen the same customer behaviour replicated in AMD’s results. However, this was absolutely not the case. In fact, their client business delivered record ASP on the back of customers opting for higher end processors:

Client revenue grew 68% year over year, marking our fifth consecutive quarter of revenue share gains. We delivered record client CPU ASP, driven by a richer mix of high end desktop and mobile Ryzen processors. Desktop channel sellout increased by more than 50% year over year.

We set new sellout records in multiple regions as our latest generation Ryzen processors became the CPU of choice for gamers, topping bestseller lists at leading global e tailers. To build on this momentum, we extended our desktop CPU portfolio with the launch of our 16 core Ryzen 9950 X3D processor that delivers significantly higher gaming and productivity performance than the competition.

I think it’s pretty obvious at this point that Intel deliberately reverted to ramping Raptor Lake production as a result of ongoing challenges with their 4/3 process nodes at Fab34 in Ireland.

Not surprisingly, much attention on the call was paid to AMD’s data centre GPU progress and plans. After the last earnings call, we noted the following in this regard:

However, what AMD has already released simply isn’t good enough to compete effectively with NVIDIA. AMD needs to regroup, get an A-Team on their software stack and double down.

This time around, the company has doubled down on their software stack. We discuss what’s been happening there, along with a very interesting development in terms of their progress on enterprise server deployment which has been an achilles heel for the company in their efforts to gain market share from Intel thus far. Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.