With Intel and AMD both now having reported fourth quarter and full year 2022 results, it’s interesting to compare and contrast how both companies have fared and how both are looking ahead to the coming year. With AMD now a worthy competitor to Intel, their results and commentary provide a fascinating contrast to what we see and hear from Intel. Let’s take a look.

Q4 2022 Results

AMD Q4 2022 revenues amounted to $5.6 billion, $100 million above the midpoint of the guided range, flat sequentially but an increase of 16% YoY.

Intel Q4 2022 revenue amounted to $14 billion, at the very bottom of the guided range down 8% sequentially and down 28% YoY.

Our Take? AMD nailed their forecast in what was undoubtedly a very challenging quarter. Intel, yet again, was overly optimistic in their forecast for the third quarter in a row. The company desperately needed to generate an earnings beat to regain a semblance of credibility, but sadly failed to do so.

FY 2022 Forecast Versus Actual

Intel published the following FY 2022 forecast from the company’s investor day in mid February 2022:

And the following slide from the latest earnings release shows how things actually worked out in practice:

For the record, the forecasted Free Cash Flow of negative $1-2 billion ended up at “approximately negative $4 billion”. CFO David Zinsner went so far as to give himself a small compliment on this achievement on the earnings call:

Through reductions in spending and significant working capital improvements, we offset a $13 billion reduction to revenue expectations to come within $2 billion of our initial adjusted free cash flow guide

Yes, you came within $2 billion of your forecast at the top end but equally, your negative FCF ended up 2x higher than what you forecasted.

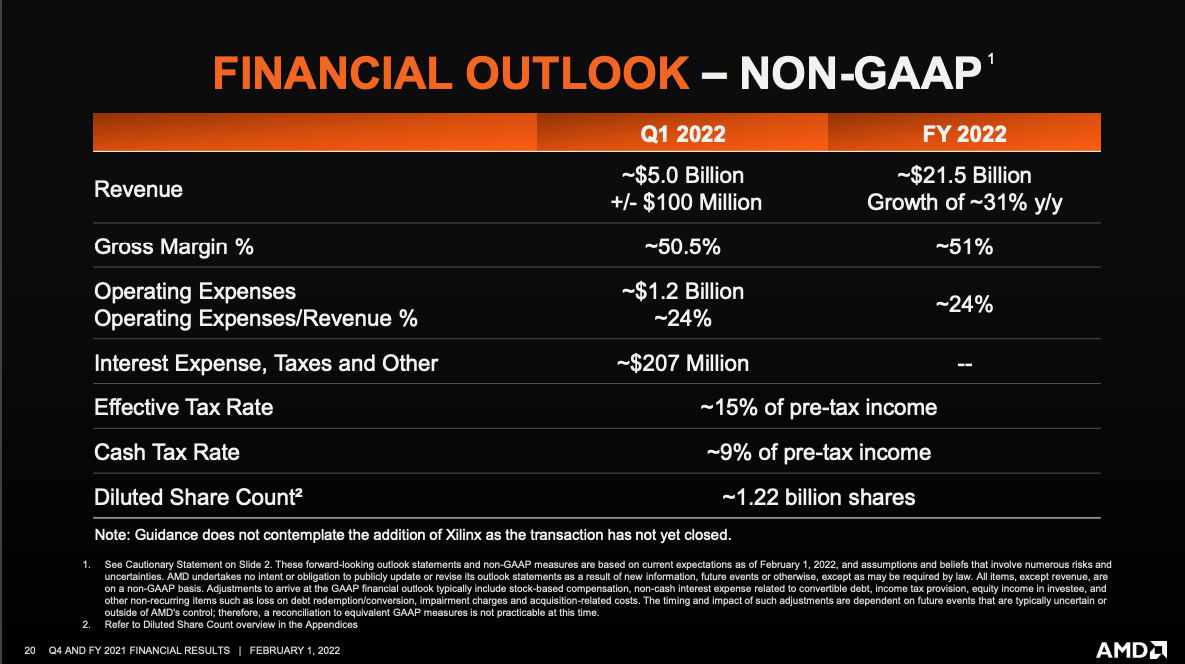

In contrast, AMD provided the following forecast on their Q4 2021 earnings call which took place on February 1, 2022:

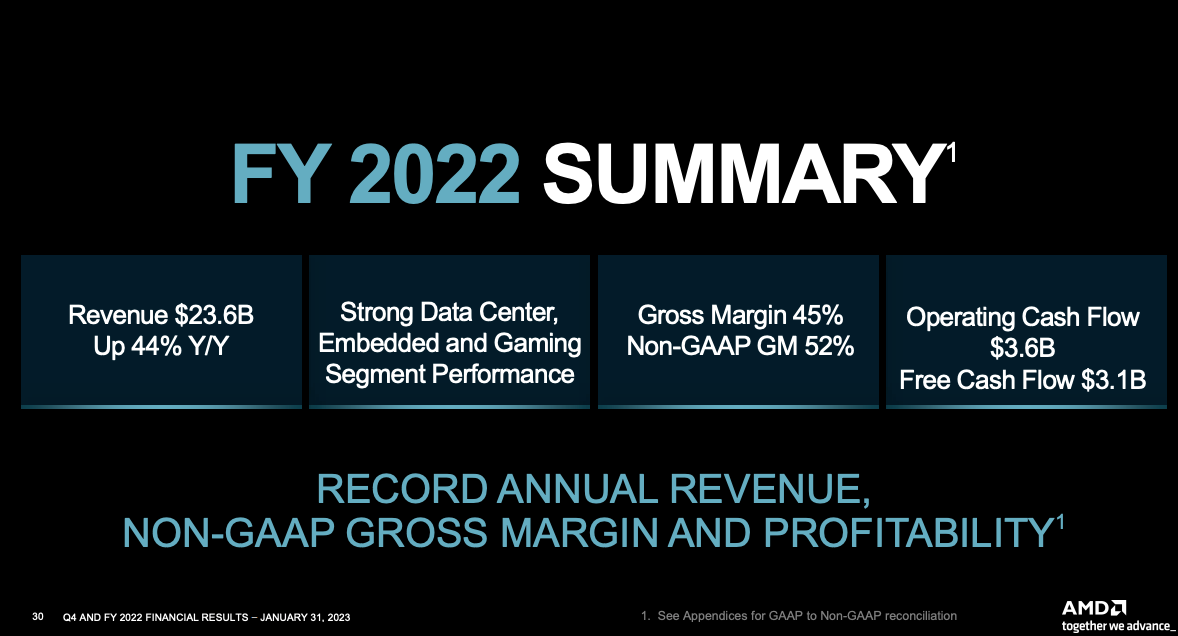

The following slide from the recent Q4 2022 earnings call shows how they performed versus this forecast:

So, a modest beat on revenue an a 1% point miss on non-GAAP GM, all while experiencing exactly the same macro economic headwinds as Intel. What a contrast!

Our Take: AMD continues to impress with their forecasting prowess. It could be argued that their fabless model makes them more nimble and easier for them to adjust wafer starts compared to Intel for example. However, I think you just as easily argue that AMD is simply light years ahead of Intel when it comes to a thoughtful, pragmatic, realistic approach to forecasting and running their business.

Q1 2023 Outlook

AMD provided current quarter guidance of $5.3 billion, plus or minus $300 million, a decrease of ~ 5.3% sequentially and a decrease of ~10% YoY.

Intel provided current quarter guidance of $11 billion at the midpoint, a decrease of and 21% sequentially and a decrease of 40% YoY

Time will tell whether AMD’s forecast proves accurate or not. However, Intel’s forecast looks more like a complete capitulation in a desperate attempt to finally generate an earnings beat in three months time. How is it possible that both companies operating in precisely the same end markets could have such radically different outlooks?

Cost Cutting & Pay Cuts

Intel’s earnings call was replete with messaging around cost cutting. They are seeking $3 billion in 2023 and expecting this to increase to an annual run rate of $8-10 billion by 2025:

As outlined last quarter, we'll continue to prioritize investments critical to our transformation, prudently and aggressively manage expenses near term and drive fundamental improvements in our cost structure longer term. We're executing well toward our $3 billion target in 2023 and $8 billion to $10 billion exiting '25

I’m puzzled as to why the cost cuts the company is planning in 2024 and 2025 cannot be identified and implemented sooner. Could it possibly be because the company has no clue where those cost savings are actually going to come from, but you need to build them into the financial model so it somehow looks better. Let’s see.

As if these cost cuts were not enough, Intel this week announced a swathe of pay cuts for all except hourly workers. You can find the details from SemiAnalysis, the first to report them, here:

In sharp contrast, AMD has not made any mention of cost cutting, let alone pay cuts. Could it be that they are right-sized for the business environment they find themselves operating in? Perhaps the leadership team has made thoughtful, pragmatic decisions over the course of the past few years?

Key Takeaways

As we reflect on these fundamental differences between how Intel and AMD have been, and still are, performing, we reach a number of important conclusions from an investor perspective. We also highlight some very likely, unintended negative consequences relating to Intel’s frenzy of cost cutting and pay/bonus cuts and finish by digging once again into a theory we have about exactly how well Intel’s 7nm process is performing relative to their 14nm+++.

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.