AMD’s Lisa Su has been honoured as Time’s CEO of the year, details here. It’s a fitting tribute to a leader who has spent the past decade pulling off what many thought to be impossible- the resurrection of a company that most had consigned to the scrap heap of history.

Ms Su assumed the CEO role from Rory Read who had spent the previous four years laying the groundwork that his successor would build on. According to his LinkedIn profile, this is how Mr. Read viewed his accomplishments in the CEO role at AMD:

At AMD, Read helped develop and led a 3 step transformation of the Fortune 500 semiconductor company, with approximately 95% of its revenue driven by the shrinking PC market. In order to transform AMD, he aggressively diversified the portfolio to produce revenue targets of 50% from new high growth markets. He focused on improving execution, lowered costs by over 30%, built 2b$ in new businesses including a clean sweep of new game consoles, implemented an ambidextrous X86/ARM approach , developed Zen next generation architecture, restructuring our debt strengthening the balance sheet and returning to non-gaap profitability.

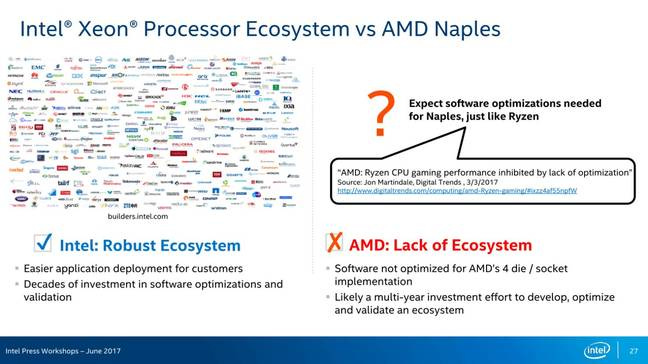

It was on Mr. Read’s watch that one Jim Keller was enticed to rejoin the company and undertake a complete overhaul of their architecture. That project resulted in what we know today as AMD’s Zen architecture. At its core is the concept of a chiplet based design. The approach was initially openly mocked by Intel in 2017, details here. Intel even went to the trouble of creating an entire slide deck to drive their point home:

Fast forward just seven years and see who’s laughing now. In my opinion, nothing symbolises the irony of Intel’s culture of arrogance and entitlement more than this infamous slide deck.

In many ways AMD’s resurgence was an overnight success that took a decade to accomplish. As CEO, Lisa Su did a masterful job of blending optimism for the company’s future with equal doses of pragmatism and humility. As an investor, I chomped at the bit for huge surges in market share gains in both client and server. Those gains came, but painfully slowly. Even as things stand today, AMD’s market share is 28.7% in desktop, 22.3% in mobile and 24.2% in server, according to the latest data from Mercury Research, details here. Note: AMD’s server share by revenue is in the mid 30’s range.

For all their success this year, most notably in carving out an entirely new $5 billion revenue segment with the MI Instinct range of accelerators, it’s not been a good year for AMD’s share price which is presently down 44% from its all time peak of $227 back in early March.

As we’ve previously noted, investing in AMD is not for the faint of heart. If you bought near the previous high back in late 2021, you would have had to wait two full years to get back in the money.

Coincidentally, AMD’s share price today is the same as it was back in November 2021, a point we have previously highlighted. So, against this backdrop, how should we be thinking about AMD’s share price heading into 2025? Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.