The origins of the current semiconductor downturn can be traced back to last May. That’s when the leading PC OEMs posted their first quarter results, and in some cases, their second quarter outlook.

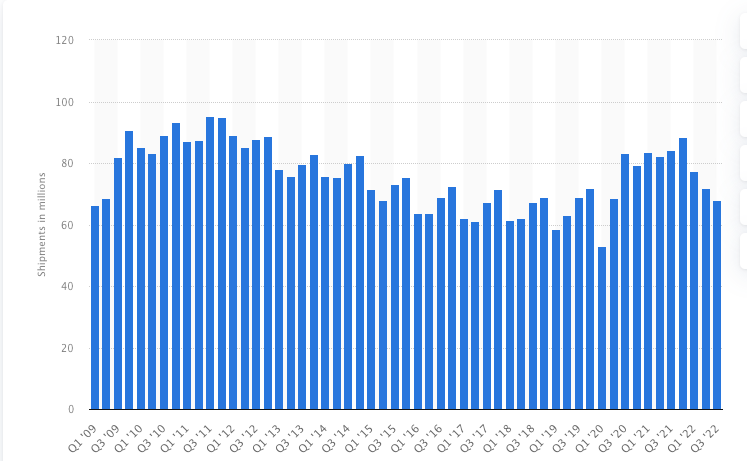

For some context, it is well understood that the pandemic roused the slumbering PC market to an extraordinary degree after the initial shock waves reverberated around the globe in Q1 2020. Up to that point, PC unit shipments had been in terminal decline since peaking in 2011.

Quarterly PC Unit Shipments (Source: Statista)

Side Note: The year 2019 bucked this trend of declining PC sales as unit shipments actually increased sequentially by around 2.8% according to Canalys

After the initial shock in Q1 2020, PC unit shipments skyrocketed over the following seven quarters, albeit there were some speed bumps along the way due to supply chain issues leading to the so-called “matched set” issues, some details here.

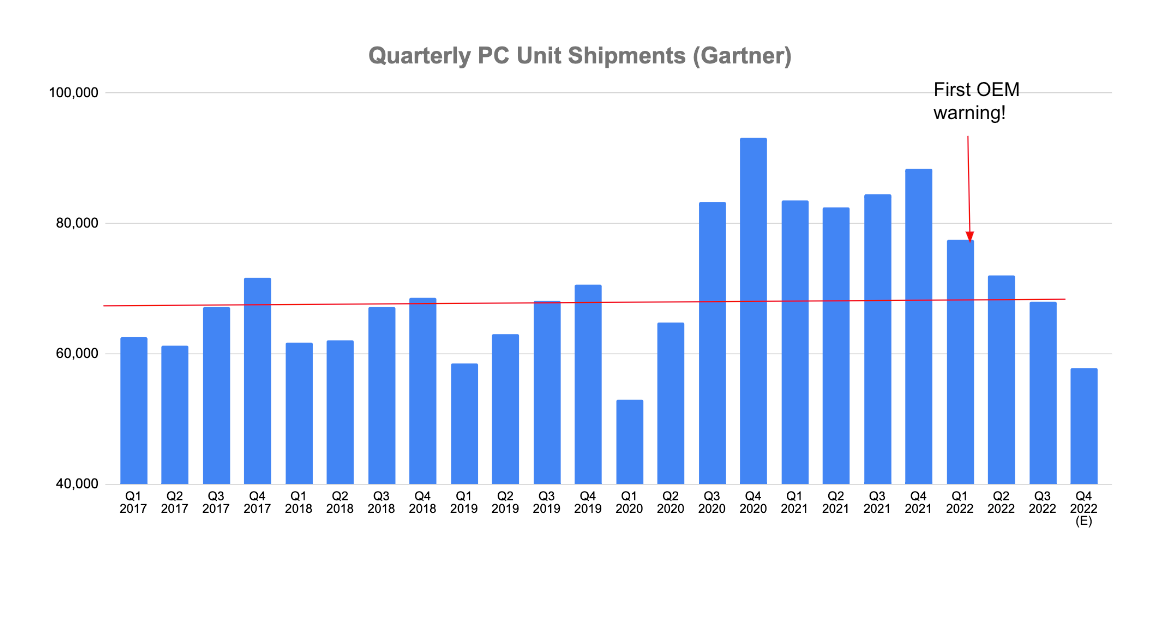

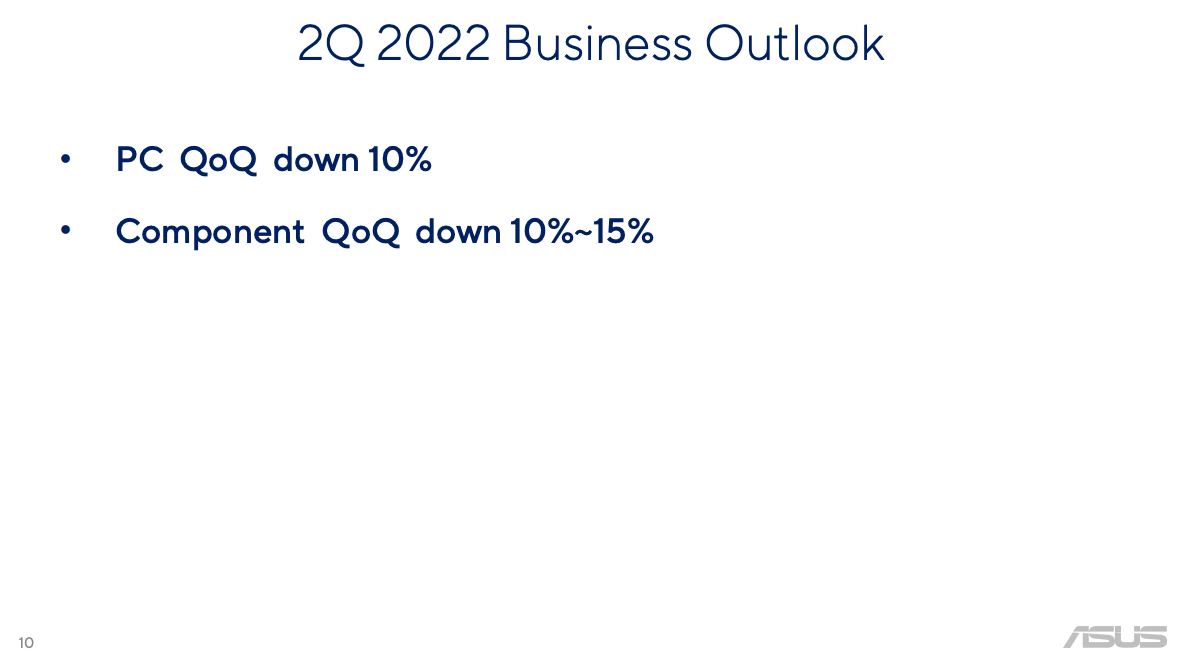

This brings us back to May 2022 and the leading OEMs reporting their results. In the case of Acer, revenues dropped 10% QoQ. It was a similar story with Asus, but to make matters worse, they forecasted that the second quarter would also be down by 10%:

At this point, it is helpful to look at the macro picture. PC unit shipments grew by 11% in 2020 and 14% in 2021. These were extraordinary growth numbers, but they were never going to be sustainable.

As the pandemic receded and households and enterprises globally had purchased all of the PCs necessary to facilitate work, learn and entertain from home, unit shipments were inevitably going to reverse course. It was always going to be a question of when and how quickly and we’ve been drip fed the answers to those questions every quarter since May. We now expect that PC unit shipments will decline by around 19% in 2022.

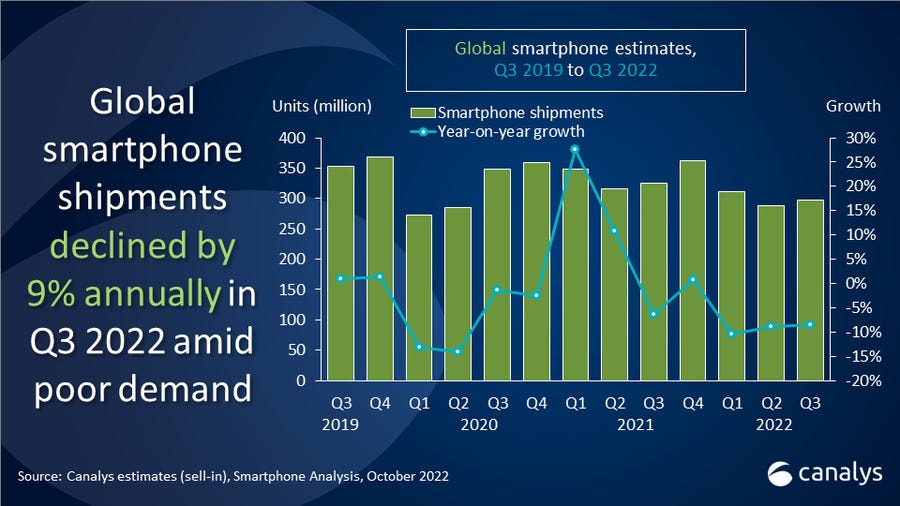

The situation with regard to smartphones is quite similar, albeit not quite as dramatic. In 2020, smartphone unit shipments actually declined by around 7% in spite of the pandemic driven upsurge in demand. Again, supply chain issues meant that demand could not be fully met.

Shipments then grew by around 7% in 2021 and again, this growth was never sustainable. At present we are on track to see smartphone unit shipments decline by around 9% in 2022.

At this point, you may be asking yourself why these declining PC and smartphone unit sales are having such a big impact on the semiconductor industry? After all, their shipment numbers are simply reverting to their pre-pandemic norms and we didn’t see anything badly wrong with those numbers back in 2019.

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.