For Its WFE Q324 Season Finale, AMAT Returns ASML's Favour & Sinks Semis Yet Again

most WFE stocks are now trading at early 2022 levels. That's tempting..

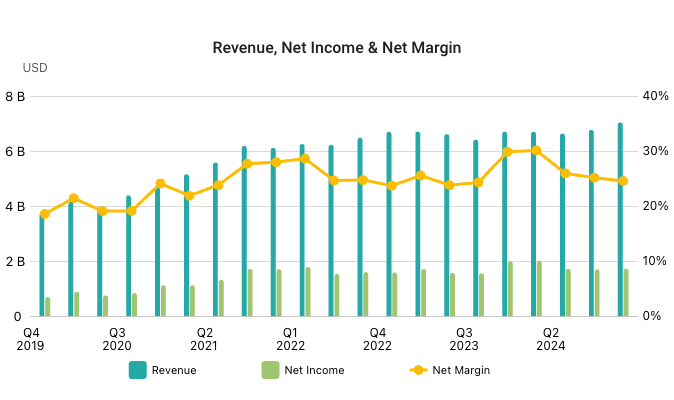

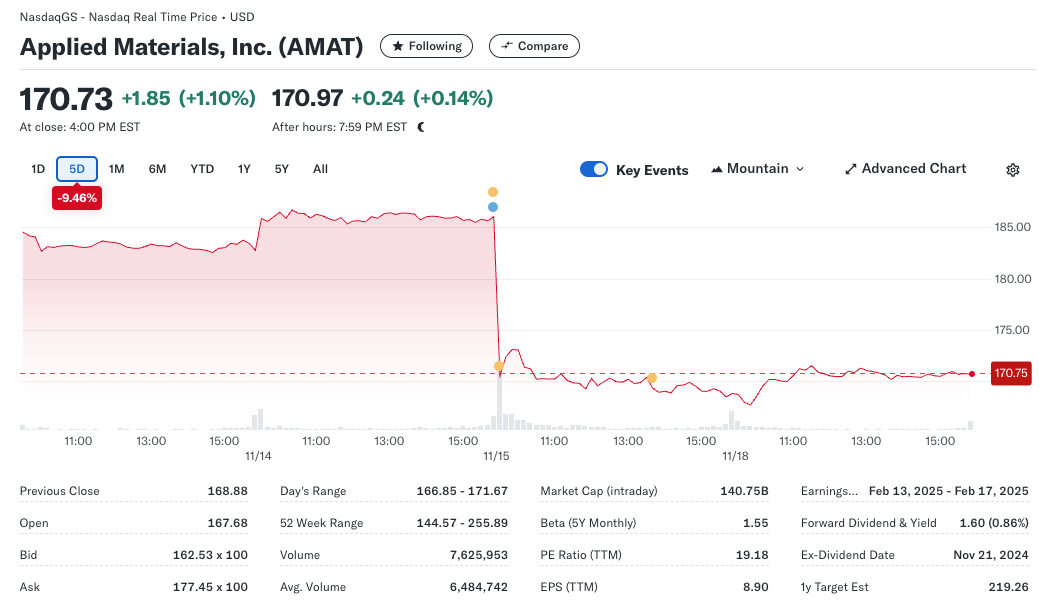

With AMAT’s report on November 15 last, the earnings season for the WFE majors ended as it began, with semi stocks one again sinking across the board. On the surface, as is becoming almost the norm, there was little in AMAT’s results that hinted at the market reaction that would follow. Revenues of $7.05 billion were marginally higher than the guided midpoint of $6.93 billion, up 4% QoQ and up 5% YoY.

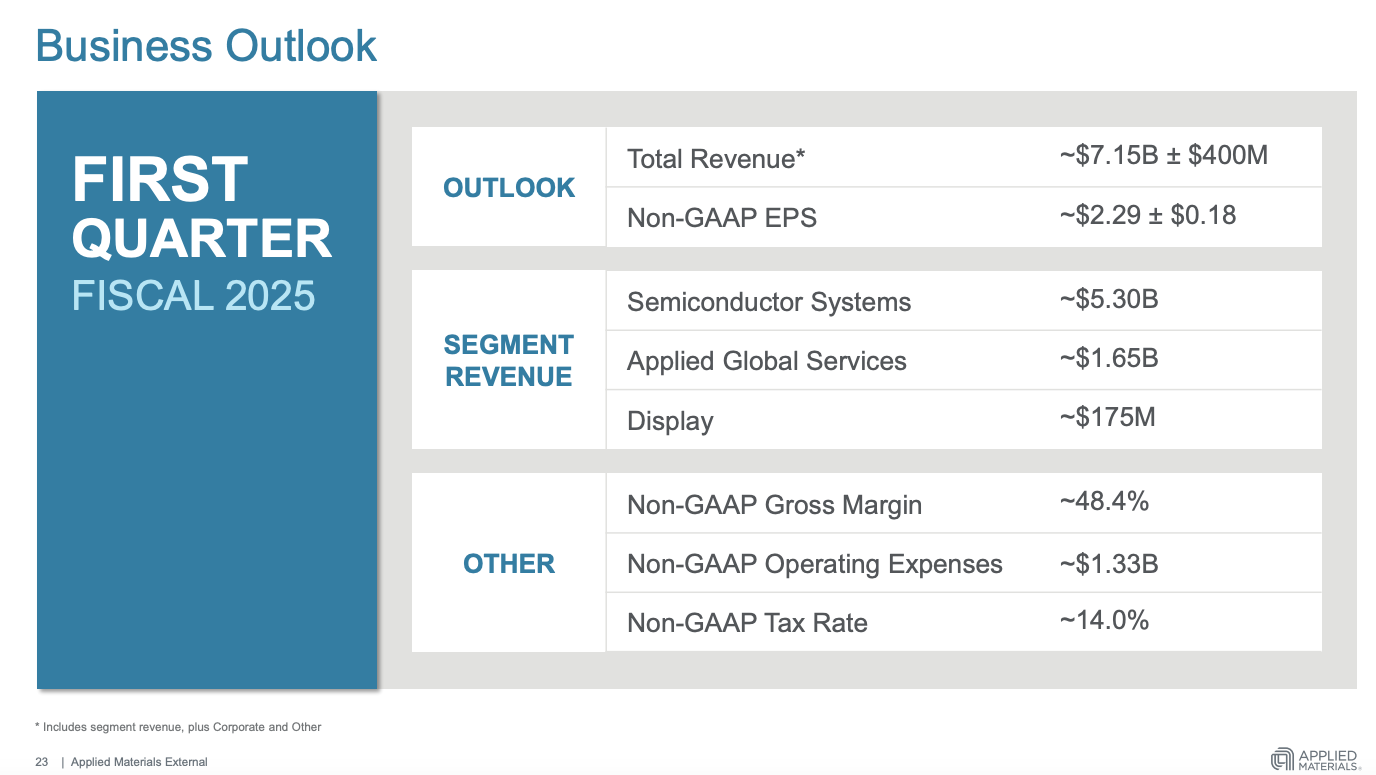

Gross margin of 47.5% was basically flat both QoQ and YoY. In terms of outlook, AMAT is expecting revenues of $7.15 billion at the midpoint, up around 1.5% QoQ and up ~10.5% YoY.

The markets were not impressed and AMAT’s share price took an 8% drop in the immediate aftermath. For good measure, it was a similar story for most of their peers.

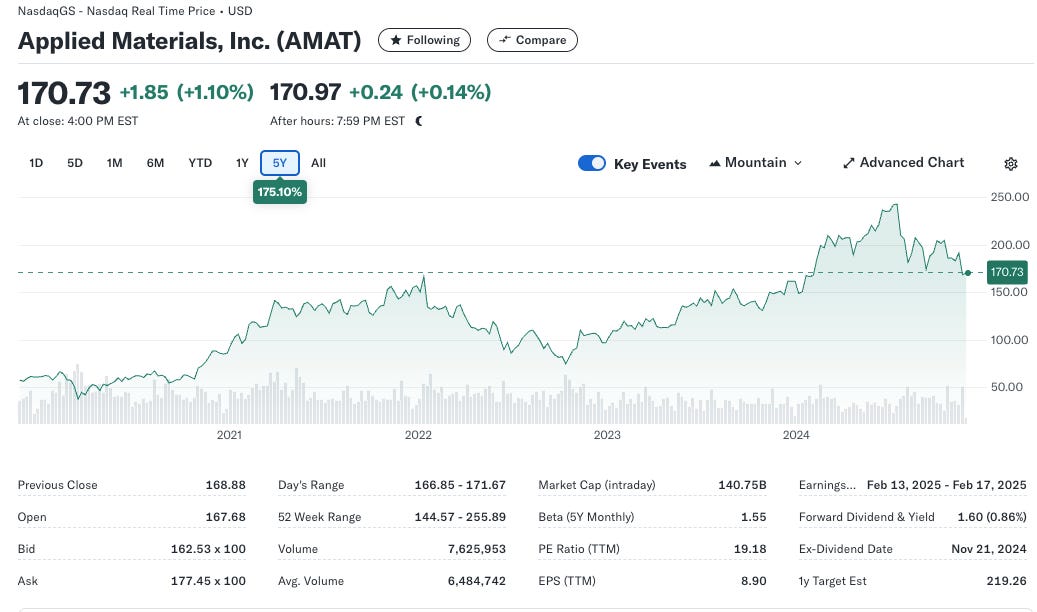

AMAT’s share price has been mostly on a downward trend since mid July and presently sits ~34% down from its peak. Its current share price of $170 is right on par with where it stood back at the beginning of 2022, almost exactly three years ago.

Interestingly, this share price reversal to early 2022 levels also holds true for LRCX, ASML and Tokyo Electron. In the case of KLAC, it’s not quite as bad but the same general downward trend applies. What’s going on with the WFE segment? Why has it fallen out of favour so much? And what’s the significance of reverting to early 2022 levels? Let’s dig in….

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.