Intel Q324. Restructuring & Impairment Charges Tank Gross Margin

and don't expect anything better in 2025

Intel announced Q324 revenues of $13.3 billion, $300 million above the guided midpoint, up 4% QoQ but down 6% YoY.

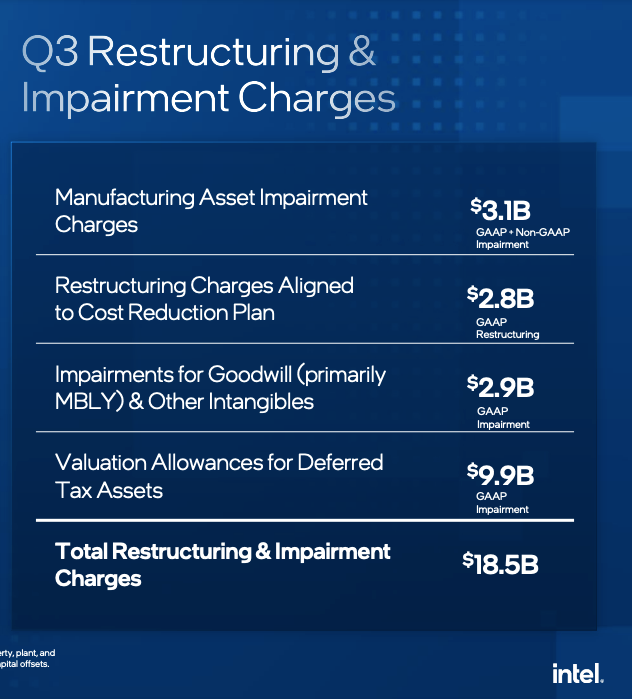

Gross margin was 18%, a full 20 points below the guided number and down 27.8% YoY, impacted by a slew of restructuring and various other impairment charges.

How convenient that these miscellaneous restructuring charges magically appear at just the right time to completely obfuscate what the actual gross margin might have been. More on this anon.

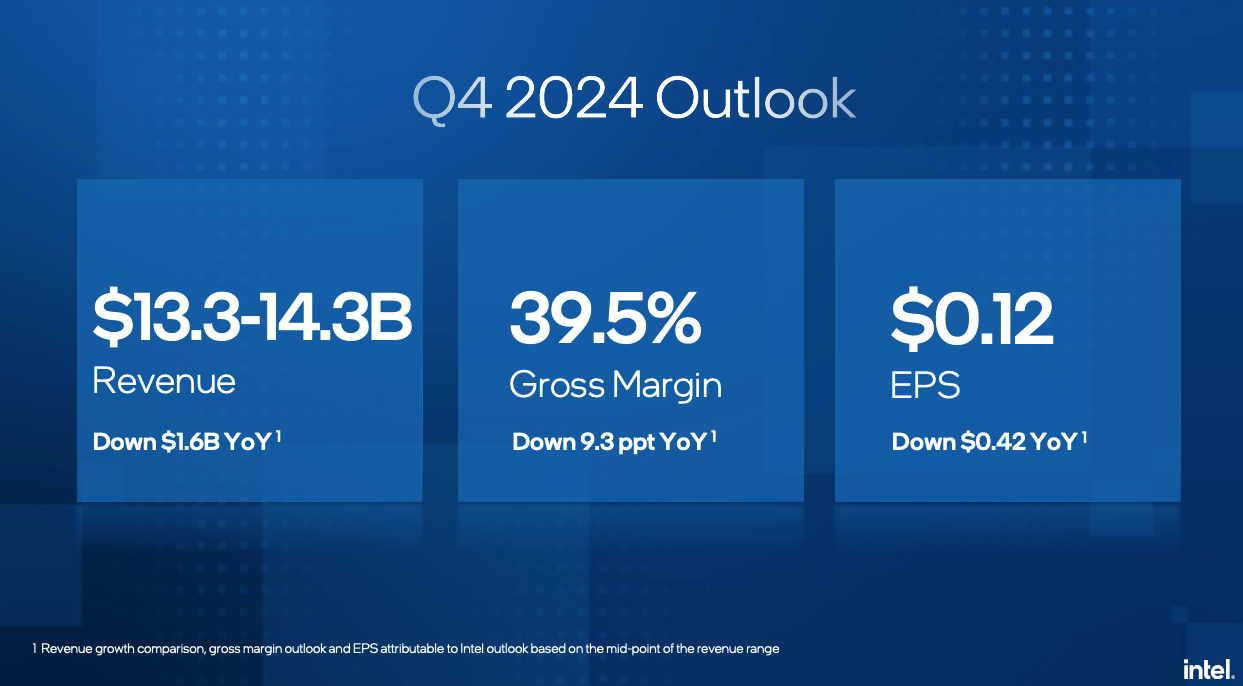

Intel guided the current quarter for $13.8 billion at the midpoint, up 3.7% QoQ, with the now customary plus or minus $500 million for safety sake. Gross margin was guided at 39.5%, down 9.5 points YoY and just a shade above the disastrous Q224 38.7% gross margin which tanked the company’s share price.

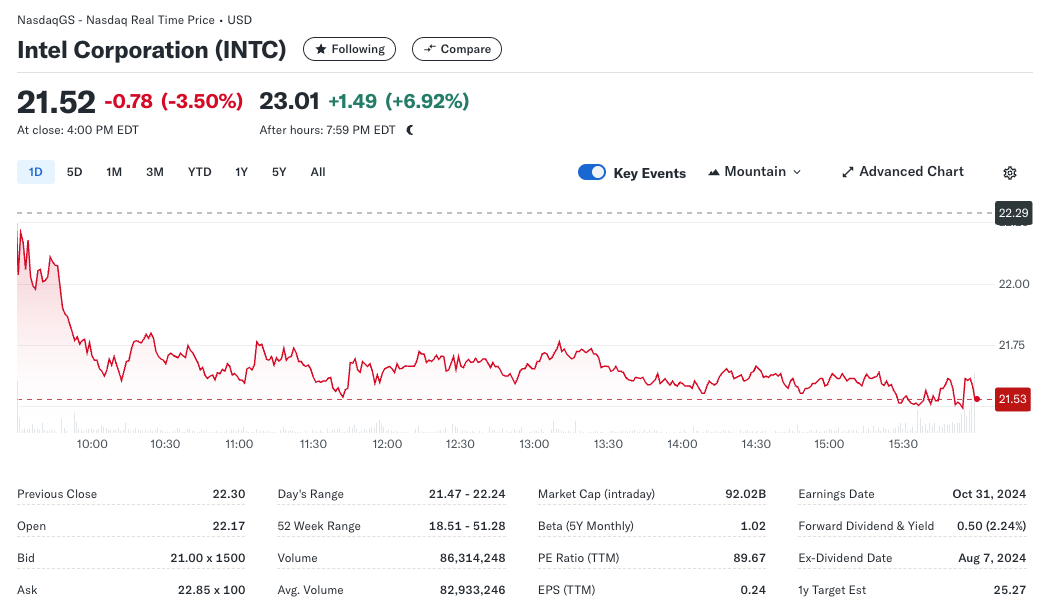

For reasons we shall discuss later, Intel’s share price soared by up to 15% in after hours trading, eventually tracking downwards to finish with a 6.92% bump. It’s worth noting that prior to reporting, Intel’s share price had been dragged down 3.5% in the bloodbath that plagued the broader semiconductor sector in the wake of earnings from the likes Meta and Microsoft the previous day.

Of particular note on the earnings call was the update on Gaudi and it wasn’t good.

While the Gaudi 3 benchmarks have been impressive – and we were pleased by our recent collaboration with IBM to deploy Gaudi 3 as a service on IBM cloud – the overall uptake of Gaudi has been slower than we anticipated as adoption rates were impacted by the product transition from Gaudi 2 to Gaudi 3 and software ease-of-use. As a result, we will not achieve our target of $500 million in revenue for Gaudi in 2024.

Thus, while AMD updated their 2024 MI300 guidance to $5 billion, Intel cannot manage even one tenth of that number…

As a result, we now expect Data Center GPU revenue to exceed $5 billion in 2024, up from $4.5 billion we guided in July and our expectation of $2 billion when we started the year.

For good measure, and in the midst to the worst crisis in the company’s history, Intel also saw fit to introduce yet another restructuring of the beleaguered company. This will lead to yet another segment reporting scheme in due course, with the associated befuddlement it will bring to all those who aspire to compare like with like down the road:

As part of our portfolio simplification, we will move our edge business into CCG (Client Computing Group) and refocus our NEX (Network and Edge Group) portfolio on networking and telco. We will also integrate our software business into our core business units to foster more integrated solutions that address our customers’ most difficult challenges. We are evaluating other portfolio actions, which we will communicate when appropriate, and we plan to provide new segment reporting that reflects these portfolio shifts in Q1 of 2025.

The Q&A session on the earnings call was one of the best I’ve seen in recent times. Hats off to the analysts who, for once, asked hard hitting questions on topics such as the relationship between defect density and yield, whether Panther Lake would still have tiles manufactured by TSMC, why foundry packaging wasn’t growing faster etc. Kudos also to Mr. Gelsinger & Mr. Zinsner who mostly answered the questions they were asked and shared some details which had been previously suspected but not confirmed by the company.

Our thoughts on the segment results impairment charges, restructuring, Lunar Lake fiasco, Q&A key takeaways & rationale behind share price bump to follow. Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.