KLAC Q324. Heavy Emphasis On Leading Edge For Growth In 2025

CEO Rick Wallace: "for years now, we've really had primarily one major player at the leading edge”

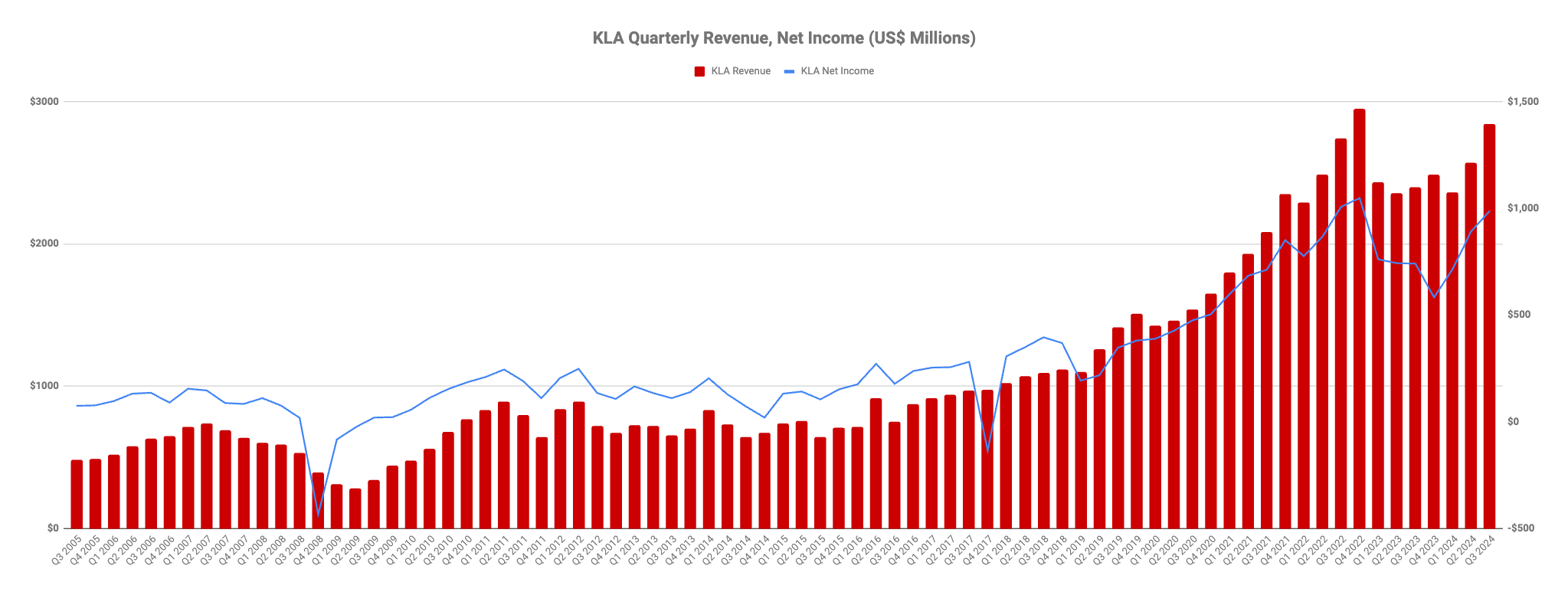

KLAC reported Q324 revenues of $2.84 billion, at the upper end of the guided range, up 10.5% QoQ and up 18.3% YoY. It marked the company’s second highest quarterly revenue ever, which was $2.95 billion back in Q422. It was also the company’s second consecutive quarter of meaningful sequential growth.

In the prepared remarks, the company noted the following:

As expected, we are encouraged by the signs of a strengthening leading-edge logic and memory market environment for our top customers and remain very confident in our plan for steady improvement and continued growth in calendar 2025.

This emphasis on leading-edge logic and memory being a growth driver into calendar 2025 was a theme that played out throughout the earnings call. More on this anon.

KLAC guided current quarter revenues of 2.95 billion, plus or minus $150 million. This represents a ~4% QoQ increase and a 18.6% increase YoY. It also matches their all time record quarterly high revenue from Q422, as previously mentioned.

In conclusion, we are guiding to our third consecutive quarter of sequential revenue growth and improving market demand at the leading edge and expect annual growth to continue in calendar 2025

If KLAC hit the midpoint of their current quarter guidance, it means that they will see CY 2024 YoY growth of 10.8%. Not bad…

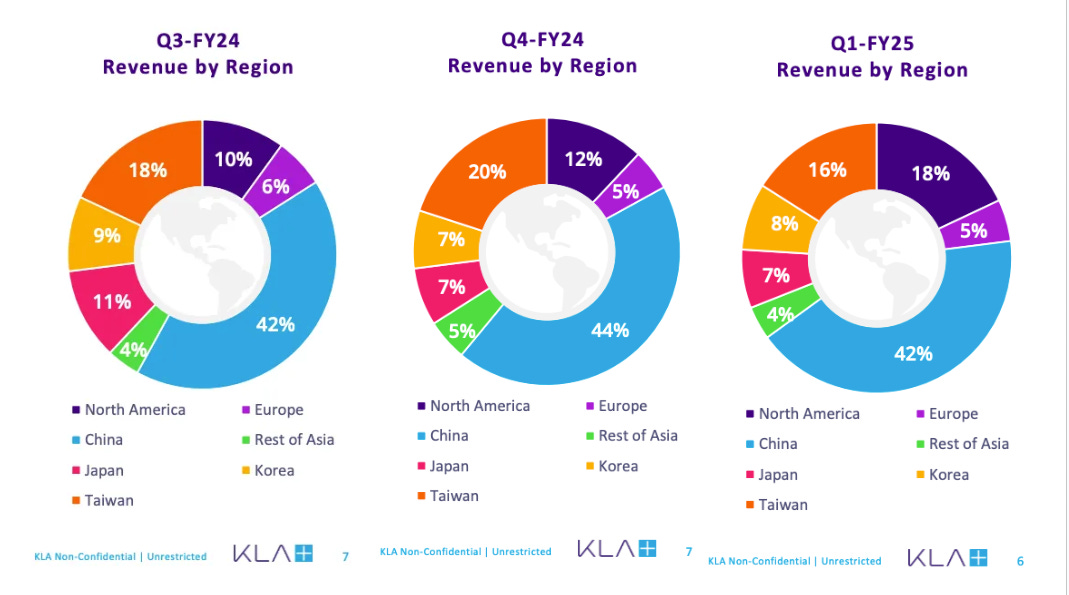

China once again accounted for the lion’s share of their revenue, coming in at 42%, down slightly from the 44% in the prior quarter. The US revenue percentage grew significantly to 18%, up from 12% in the prior quarter. Most likely this relates to TSMC ramping their Arizona fab.

Much of the earnings call was dedicated to scrutinizing the China revenue outlook, impact of potential new sanctions etc. When it came to their outlook for 2025, apart from the previously noted quote referencing “continued growth”, the company remained tight lipped, probably a good strategy these days.

However, despite saying very little about 2025, they managed to sow confusion in the minds of the analysts on the call. In particular, they stated that they expected that China as a percentage of revenue would decline, but at the same time it might amount to the same dollar value. This of course implies a strong up-tick from ex-China regions.

For the record, they also contradicted themselves when talking about leading edge customers, at one point stating that “there's a lot of players at the leading edge” only to state, in the very next sentence, “for years now, we've really had primarily one major player at the leading edge”. How confusing is that! More on both these points shortly.

We last wrote about KLAC back in May:

In our conclusion to that piece, we noted the following:

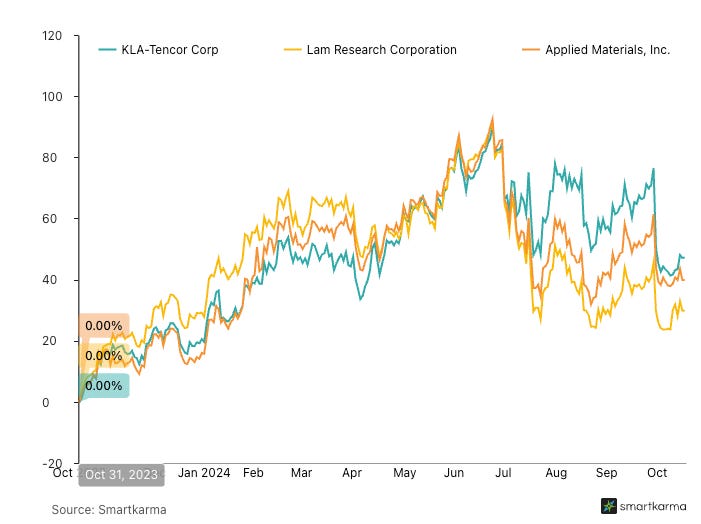

KLAC, and pretty much all their peers, are great companies, largely very well run and with a critical role to play in the future of the semiconductor industry. However, I find them all overpriced at present and am concerned by the apparent disregard of the simple fact that 2024 will be at best a very modest growth year for them. Oh and there’s that China addiction thing as well. Let’s see..

Over the course of the following two months, KLAC and their peers soared to all time record highs only to then correct back to March/April 2024 levels, where they largely remain today.

KLAC’s latest earnings call had little impact on their share price, presumably an indication that there were no surprises in the print. What was surprising was their continuous emphasis on the “leading edge”, both for logic and memory. Indeed, they made the bold prediction that leading edge will once again overtake legacy to become the largest percentage of the business (presumably here they mean the broader semiconductor business, and not just their own)

But when we look to 2025 and then look beyond to the model we had for 2026 or even what we'll start talking about 2030. We think we're getting back to the historical levels where leading edge is what's driving the growth, it's the largest percent of the business and the legacy will be a smaller percent. When exactly that happens, we don't know.

Why did they spend so much time talking about leading edge and what are the implications of it once again overtaking legacy as a percentage of the overall business? Let’s dig in….

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.