Micron Q325 Earnings. NAND's Surprising Rebound While HBM Already Reaches $6 Billion Annual Run Rate.

DRAM revenue reached a new record driven by a nearly 50% sequential growth in HBM revenue

Micron reported Q325 revenues of $9.3 billion, up 15% QoQ and up 37% YoY and $500 million above the guided midpoint. This represented a new quarterly revenue record for the company.

Gross margin was 39%, up 250 basis points compared to the guided midpoint:

Gross margins were above the high end of our guidance range, primarily due to better prices for both DRAM and NAND, partially offset by a higher consumer oriented mix.

Looking ahead, Micron forecasted current quarter revenues of $10.7 billion, up 15% QoQ, with gross margin of 42%, up 300 basis points sequentially

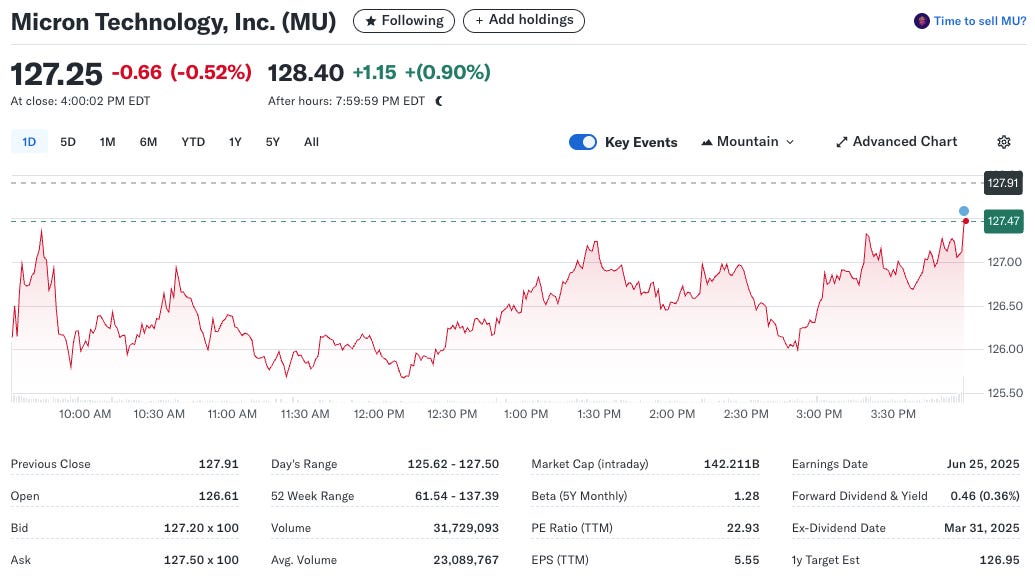

While the quarterly results were a beat on every metric, the markets were unimpressed with Micron’s share price registering a measly 0.9% bump in after hours trading

One suspects this reaction has less to do with the results and more to do with the ~80% increase in Micron’s share price since its mid-April lows of around $70

It was an upbeat earnings call across the board with CEO Sanjay Mehrotra highlighting multiple records achieved by the company during the quarter, most notably:

Data center revenue more than doubled year over year and reached a record level, and consumer oriented markets had strong sequential growth.

In fiscal Q3, DRAM revenue reached a new record driven by a nearly 50% sequential growth in HBM revenue.

We remain the sole supplier in volume production of LP (low-power) DRAM in the data center.

In NAND, we achieved a new quarterly record for market share across data center SSDs (solid-state drives), as well as client SSDs in calendar Q1.

For the first time ever, during calendar Q1, Micron has become the No. 2 brand by share in data center SSDs, according to third-party data.

Of particular interest to us on the earnings call were the following points:

#1 a sharp rebound in NAND revenues QoQ despite ASPs declining in the high single digits percentage range

#2 the decision to End of Life the company’s legacy D4 and LP4 products

#3 confirmation that their HBM run rate has already exceeded $6 billion on an annual basis

#4 no update on customer negotiations regarding CY 2026 supply and pricing. This was something of a surprise given that these negotiations have being going since the prior earnings call. What gives?

Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.