Micron. So Long Legacy & Hello There HBM, Data Center & Leading Edge

the memory industry is going through a transformation

I think it would be fair to say that Micron’s Q1F25 earnings report last week put the proverbial cat among the pigeons. The report started out well, with the key metrics handily meeting guidance

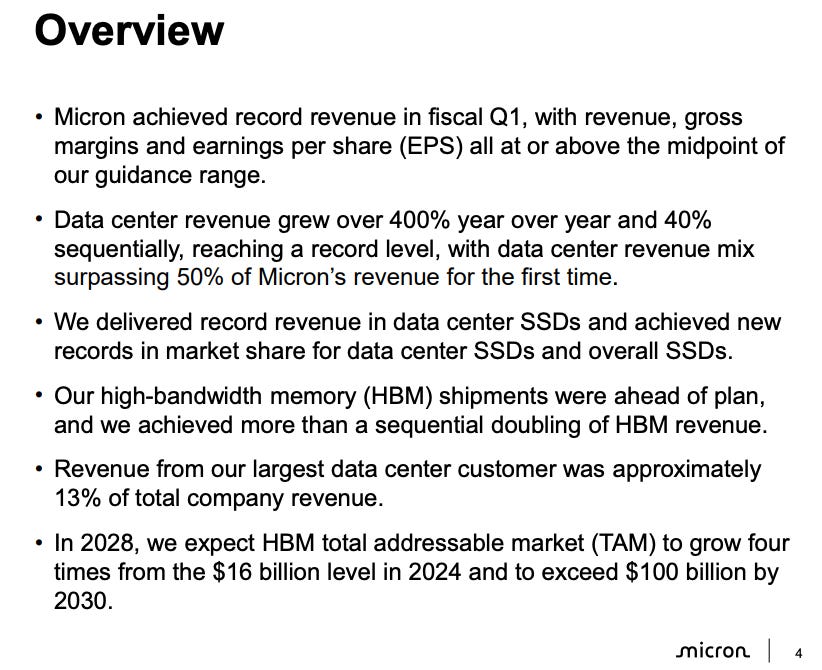

Micron delivered fiscal Q1 revenue and gross margins at the midpoint and EPS above the midpoint of the guidance range. Total fiscal Q1 revenue was approximately $8.7 billion, up 12% sequentially and up 84% year over year, and reached a new record.

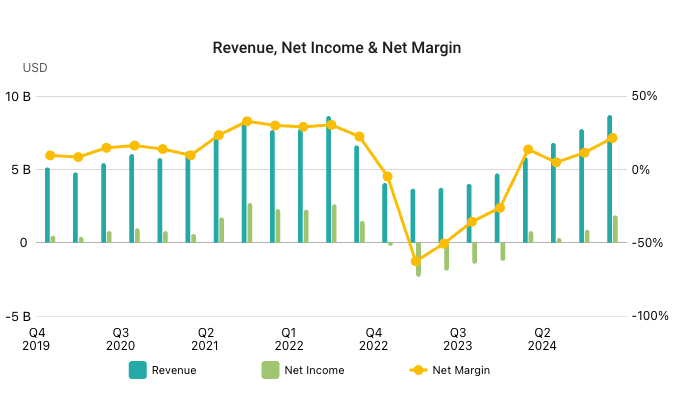

Q1F25 marked the company’s seventh consecutive quarter of sequential growth as Micron gradually clawed its way back from the most severe downturn the industry has seen in well over a decade. To be sure, that recovery was due in no small part to the unprecedented demand for leading edge DRAM to feed the insatiable appetite of accelerated computing. More specifically, demand for HBM is off the charts, and Micron is one of just three companies on the planet with the wherewithal to meet that demand:

Our HBM shipments were ahead of plan, and we achieved more than a sequential doubling of HBM revenue. Revenue from our largest data center customer was approximately 13% of total company revenue. The HBM market will exhibit robust growth over the next few years

Just how robust will this growth be and what does it mean for Micron?

In 2028, we expect the HBM TAM to grow four times from the $16 billion level in 2024 and to exceed $100 billion by 2030. Our TAM forecast for HBM in 2030 would be bigger than the size of the entire DRAM industry, including HBM, in calendar 2024.

This HBM growth will be transformational for Micron, and we are excited about our industry leadership in this important product category.

The key word here is transformational and reflects a theme will echo throughout this note.

This transformation is best viewed through the lens of Micron’s Data Center market segment which saw revenues soar by over 400% YoY in the company’s FY25. This revenue is not just coming from DRAM & HBM, it’s also stemming from record data center SSD shipments.

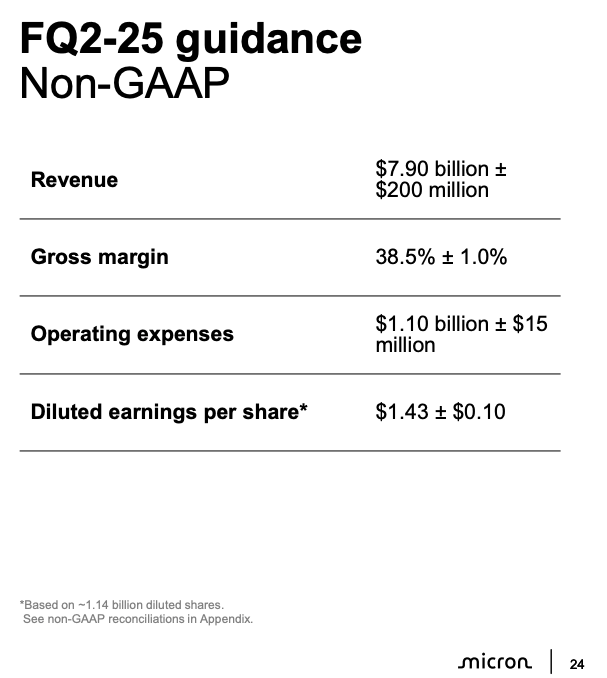

Against this backdrop, Micron guided the current quarter at $7.9 billion, down ~9% sequentially but still up ~67% YoY

This, not surprisingly, was not what the markets expected or wanted to hear and Micron’s share price fell by ~17% in overnight trading.

This leaves Micron down ~43% from its 52 week high and trading roughly where it was in early 2021, a full four years ago. Ouch!

So what’s going on? Micron’s growing HBM revenue stream is entirely new and should be augmenting existing revenue streams from its traditional products. Furthermore, the broader memory segment has been in recovery mode for over a year at this stage, with ASPs for both DRAM and NAND increasing in each of the past six quarters in the case of SK Hynix and Samsung, and in each of the past five quarters in Micron’s case. Has this recovery now reversed course? Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.