Semiconductor Memory Q125 Review, Tariff & Tech Transition Impacts, HBM Outlook Etc.

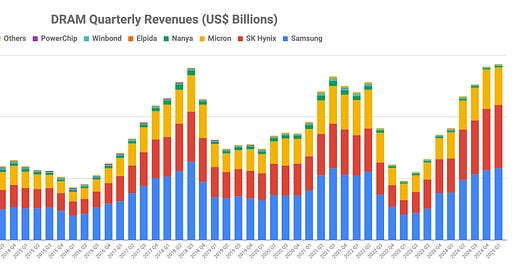

The recovery in semiconductor memory, which has been underway since Q223, stalled in Q125 in the case of DRAM while NAND accelerated a downward trend that began in Q424. DRAM revenues for the first quarter amounted to $28.6 billion, up 1.5% QoQ and up 57.4% YoY.

In the case of NAND, first quarter revenues amounted to $13.3 billion, down 20.6% QoQ and down 5.5% YoY.

The DRAM market is obviously being greatly supported by demand for HBM, and that demand continues to grow. In the case of SK Hynix for example, they expect HBM demand to double YoY in 2025

If this is the case then why did DRAM revenues show such anemic growth in the first quarter? Furthermore, what’s driving the meaningful decline in NAND revenue? Thoughts on these, tariff impacts on the industry and outlook for the current quarter ahead of Micron earnings coming up on June 25 next. Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.