Semiconductor Memory Q324 Revenue Close To Historic Highs Even As Decoupling Intensifies

China looks set to gain share in the legacy end of the market

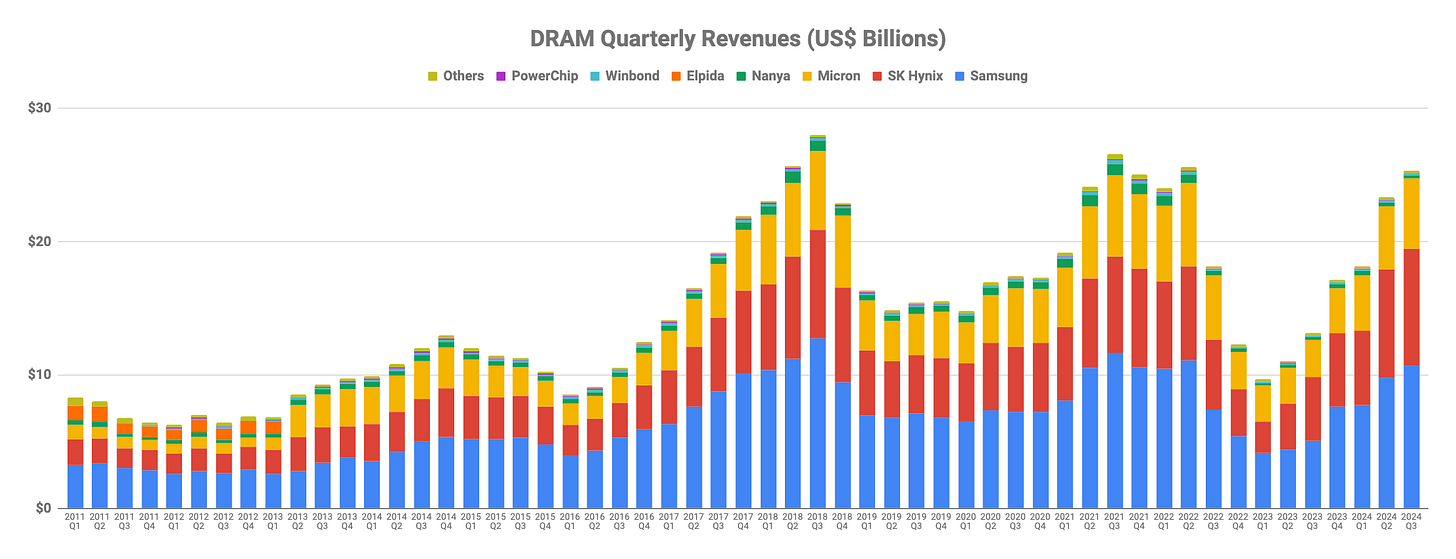

Both DRAM and NAND added yet another quarter to their five-quarter growth spurt in Q324. In the case of DRAM, revenues amounted to $25.4 billion, up 8.58% QoQ and up 92.4% YoY.

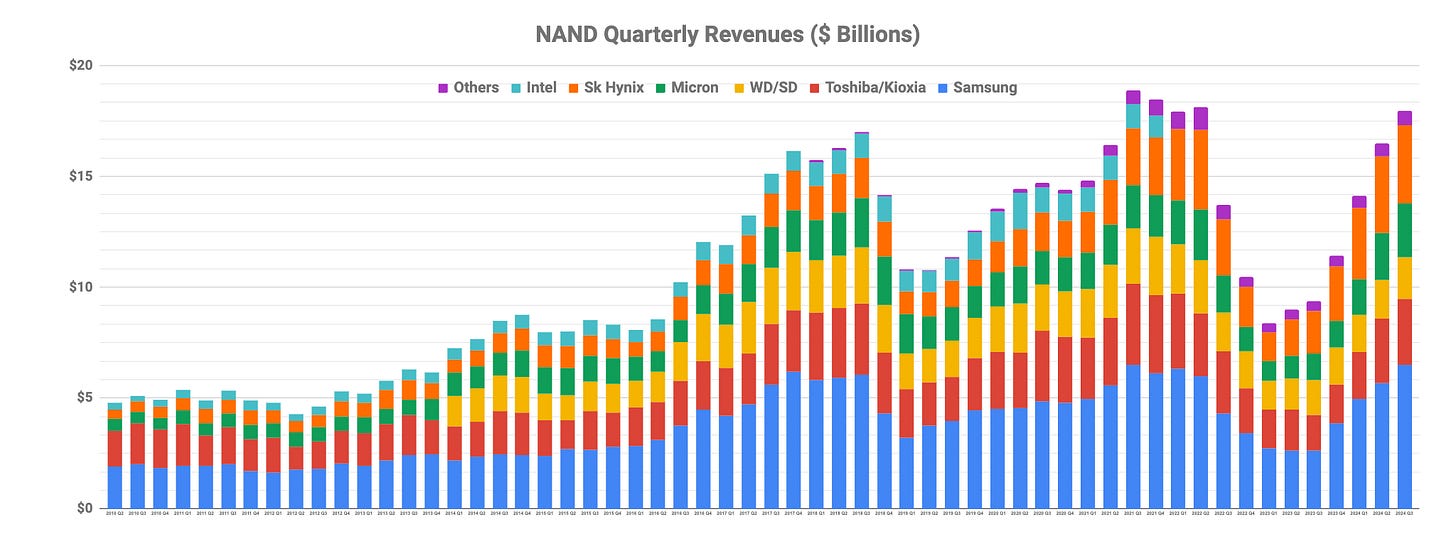

NAND revenues reached $17.9 billion, up 9.8% QoQ and up 93.6% YoY, remarkably similar to what we saw in DRAM.

Both DRAM and NAND are now within a hair’s breadth of their all time historic quarterly revenue highs and, not surprisingly, their growth rates are slowing.

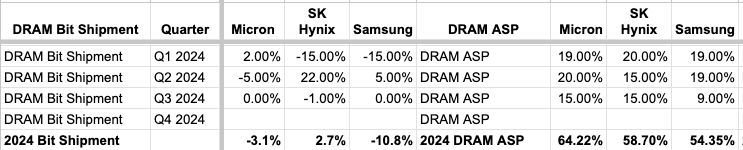

While DRAM bit shipments remained muted during the quarter, ASPs continued to grow strongly, and almost in lockstep among the three major players. SK Hynix has now racked up six consecutive quarters of robust DRAM ASP increases, Samsung five quarters and Micron four.

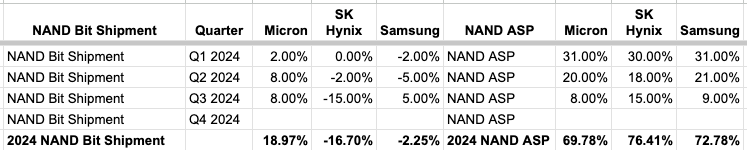

It’s a similar story as far as NAND is concerned, albeit the bit shipment picture is more varied. For SK Hynix, bit shipments dropped 15% while Samsung grew 5% and Micron grew 8%.

Note: Samsung’s transcript is somewhat confusing on the topic of NAND bit growth:

Third quarter bit growth was flat Q-on-Q for DRAM and down to single-digit growth for NAND.

I interpreted this to mean growth of 5%, but I can see how it could be interpreted differently. I’m waiting on a reply from their IR team.

NAND ASPs also grew nicely during the quarter with SK Hynix leading on 15% while Micron and Samsung were neck and neck on 8% and 9% respectively.

On their earnings call, Samsung coined a new term, decoupling, and they talked about it quite a bit. We explain what this is, share some key takeaways from the Samsung and SK Hynix calls and lay out our view on what lies ahead for the memory industry in the quarters ahead. Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.