Semiconductor Silicon Wafers Segment Q4 & 2022 Roundup, 2023 Outlook

Customer inventories rose rapidly in the fourth quarter

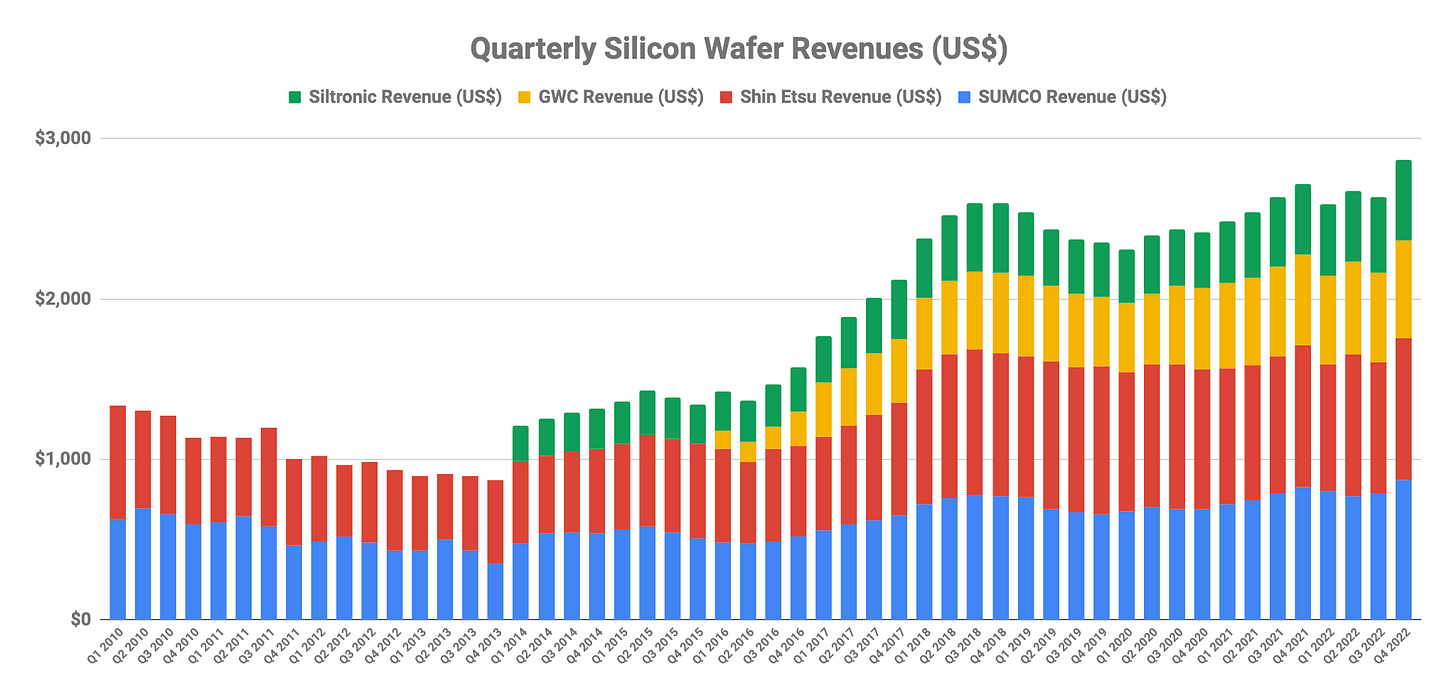

Worldwide silicon wafer shipments declined ~4% sequentially in the fourth quarter reaching 3,589 MSI. Despite this decline, revenues actually increased by around 8%, thanks mainly to the positive effect of the US$ to JPY FX fluctuations on the earnings of SUMCO and Shin Etsu.

Source: Respective Company’s Q4 2022 Earnings Reports

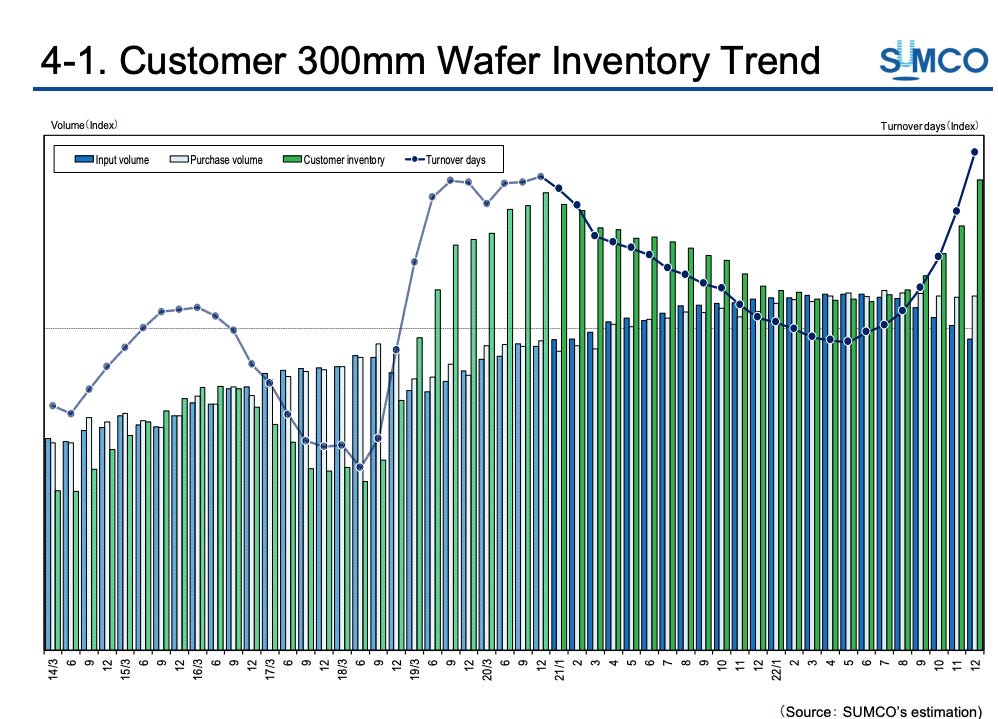

This sequential decline in area shipments came as little surprise. While large swathes of the semiconductor industry transitioned into a downturn as 2022 progressed, the silicon wafer segment remained largely unaffected. This situation changed in the fourth quarter as customer inventory levels rose rapidly, most particularly for logic wafers as the following graphic, courtesy of SUMCO, clearly shows.

Source: SUMCO Q4 2022 Earnings Report

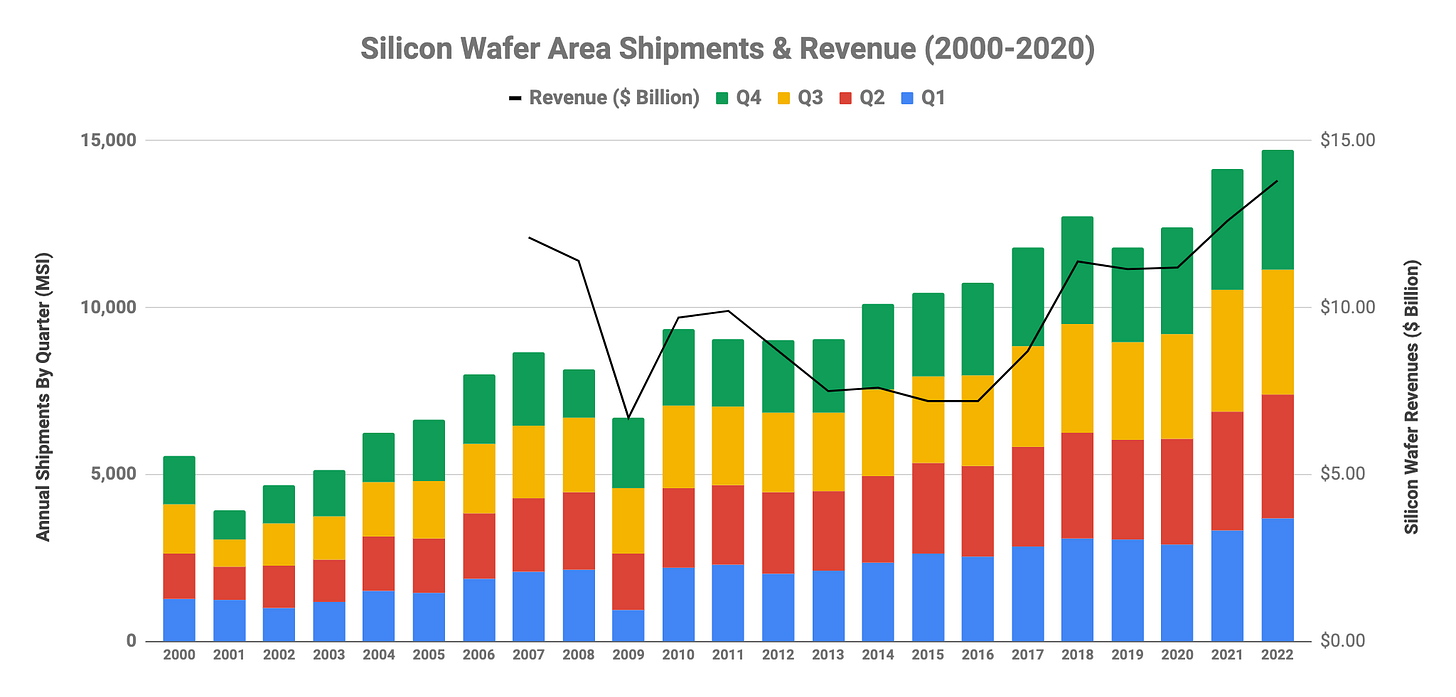

For CY 2022 as a whole, wafer shipments amounted to 14,713 MSI, a YoY increase of ~4%. Revenue growth outpaced area shipments, rising 9.5% to $13.8 billion

Source: SEMI

We expect a further sequential decline in wafer area shipments in the current quarter. For example, in the case of SUMCO, the company noted the following on their fourth quarter earnings call:

300 mm wafers for memory use entering strong correction phase; varying demand seen for logic applications depending on the customer, but should end with slight overall correction; strong demand seen continuing for automotive use.

200 mm wafers will see weak demand for smartphone use, etc. but strong automotive and industrial use demand

Correction phase to continue for 150 mm and smaller wafers, mainly for consumer needs

Pricing - For both 300 mm and 200 mm wafers, should improve in line with contract prices, while varying on the spot market depending on the industry

Thus, while automotive and industrial demand remain strong, memory & logic have entered a correction phase.

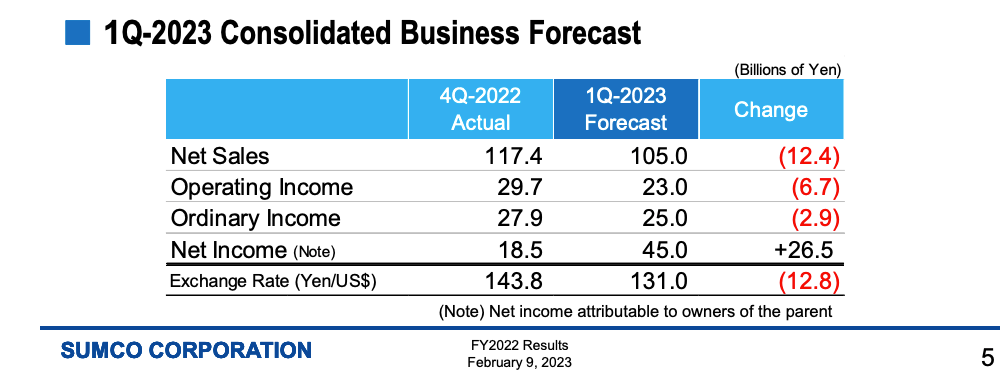

Source: SUMCO Q4 2022 Earnings Report

As a result, SUMCO is forecasting a ~10% sequential decline in Q1 2023 revenues. While their competitors have not published current quarter forecasts, we anticipate that they will post similar declines.

Full Year 2023 Outlook & Analysis

What will be the impact of weakening demand and rapidly rising inventories on the silicon wafer segment as we move through the year? How does CapEx spending look in 2023 and where is it being spent? What are some of the key recent developments in the sector from an M&A perspective?

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.