Semiconductors: 2022 Review, 2023 Outlook

Server unit shipments showing significant declines from 2022 highs

2022 In Review

The following table summarises the growth rates for each of the key segments that make up the broader semiconductor market:

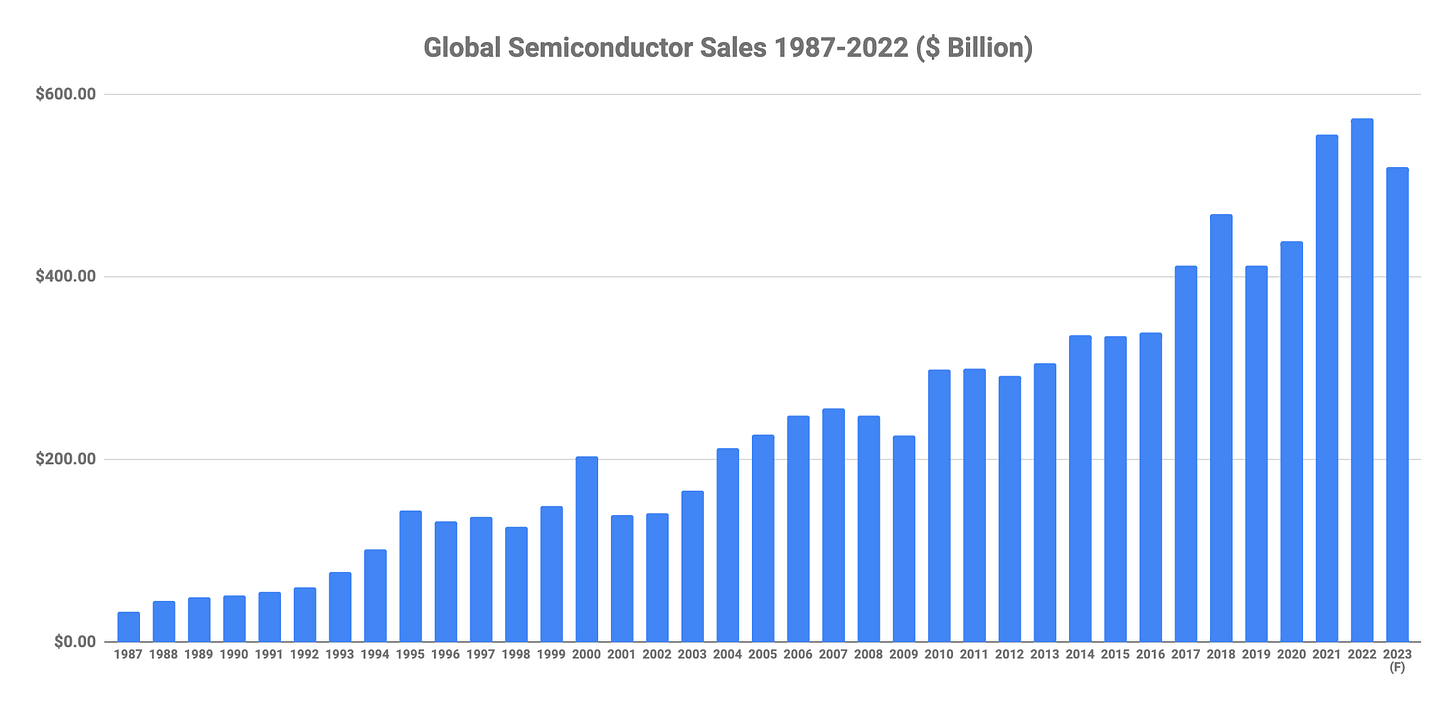

Let’s review each segment in turn. Global semiconductor sales totaled $573.5 billion in 2022, the highest-ever annual total and an increase of 3.2% compared to the 2021 total of $555.9 billion.

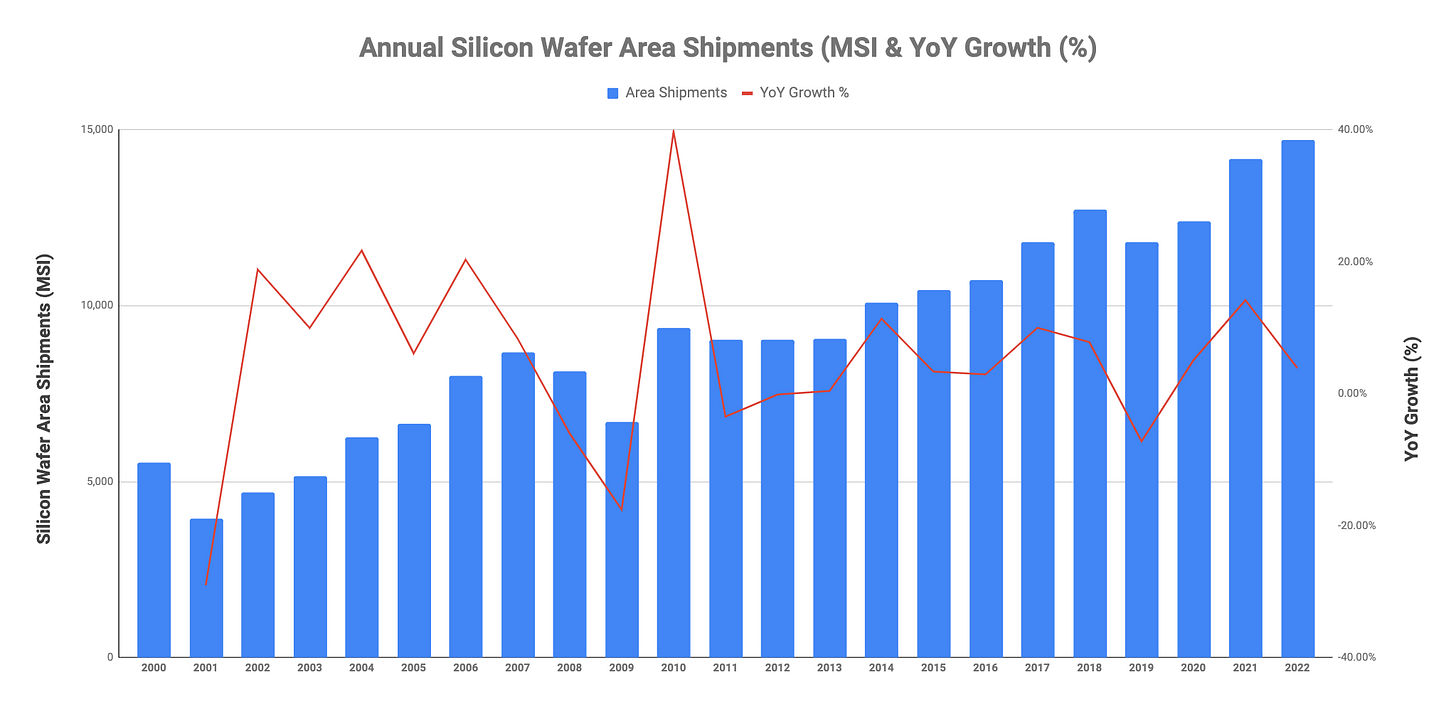

Silicon wafer area shipments amounted to 14,713 MSI in 2022, a YoY increase of ~4%. Revenue growth in 2022 outpaced area shipments, rising 9.5% to $13.8 billion.

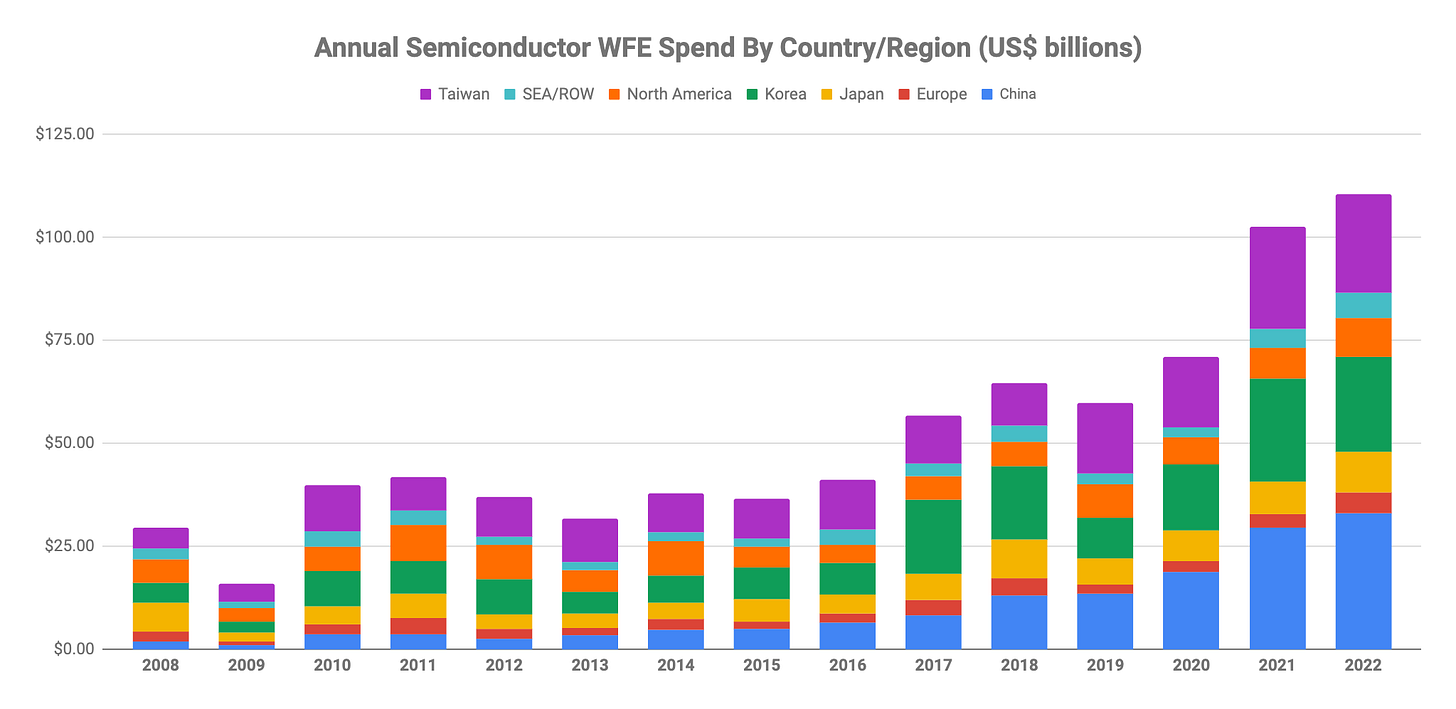

For FY2022, revenues of the top equipment manufacturers grew by 7.5% to reach ~$94 billion, an all time record high. Interestingly, that growth was not shared equally among the competitors. KLA fared best with 28% YoY growth while Tokyo Electron fared worst with a ~3% decline.

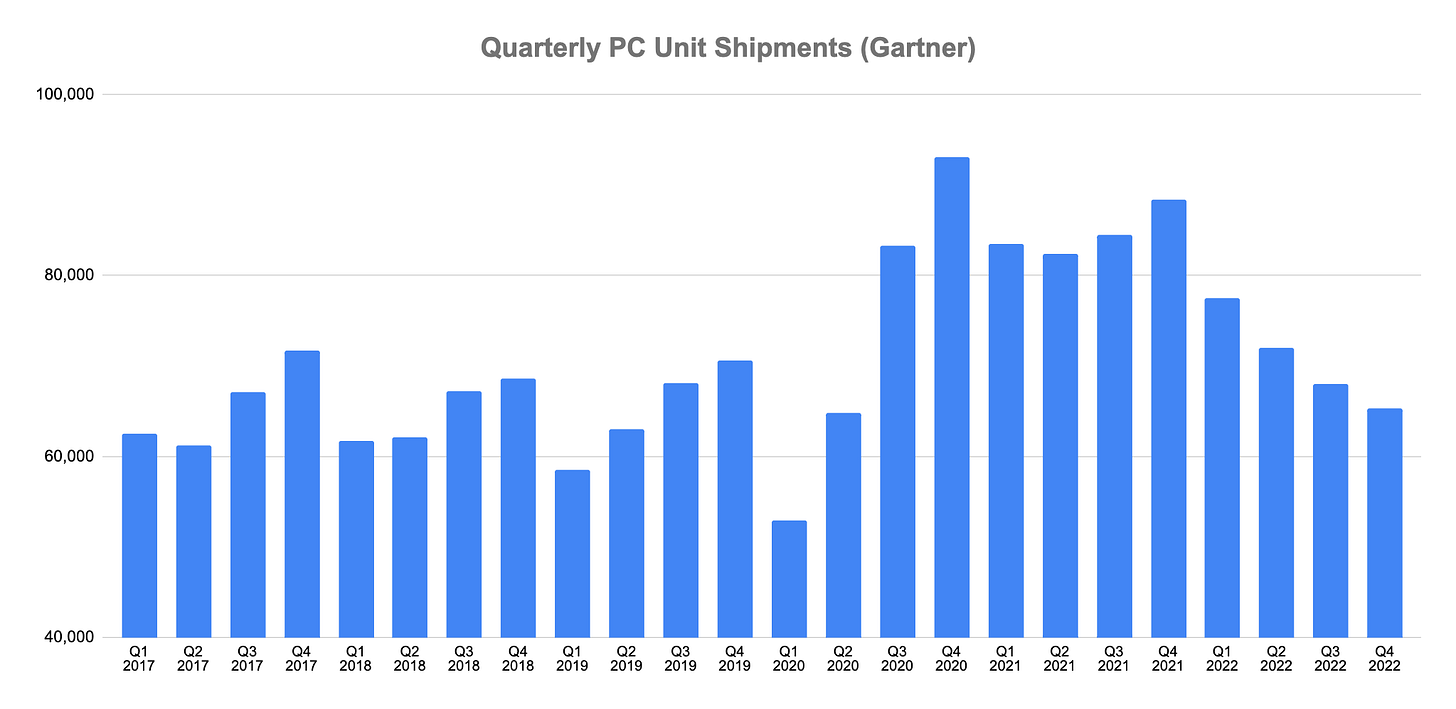

For FY2022, PC unit shipments fell by 16.2% according to Gartner. Unit shipments declined each quarter last year and the Q4 unit shipments of 65,300 compares to 70,612 units shipped in Q4 2019, the most recent pre-COVID quarterly comparison available.

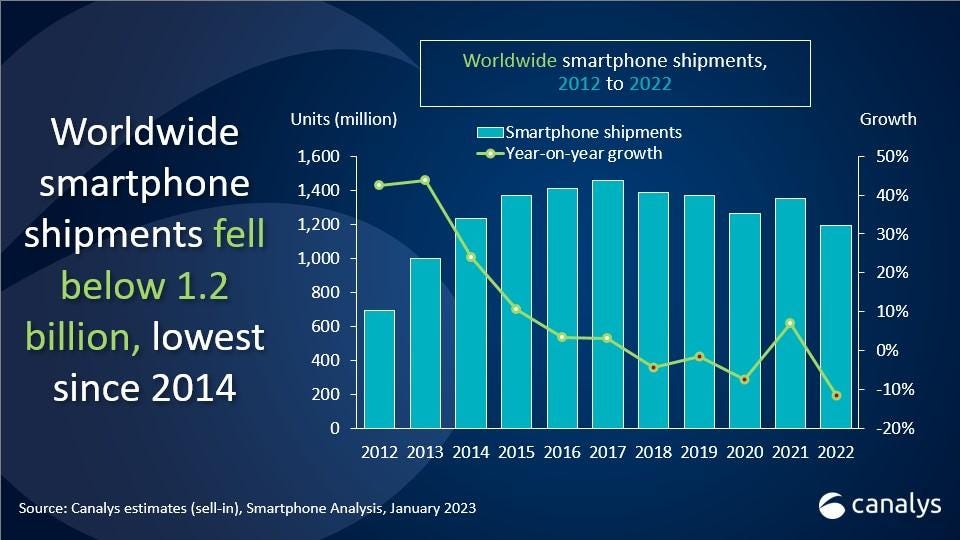

Smartphone shipments declined by 12% in 2022, according to Canalys, the lowest since 2014:

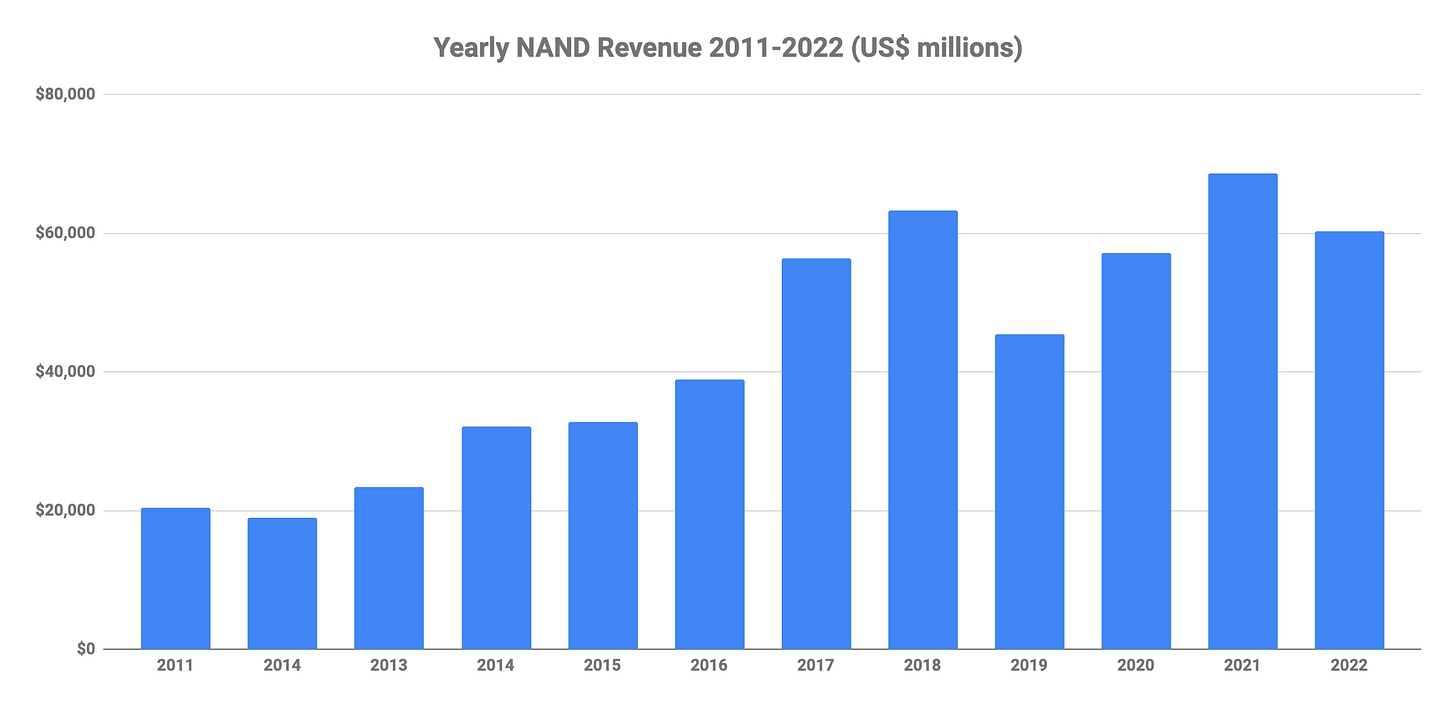

2022 was clearly a year of two halves for the NAND business. While the first two quarters saw near record revenues, the last two quarters saw severe sequential declines. Full year revenues fell to $60.2 billion, a decline of 12.22 % YoY

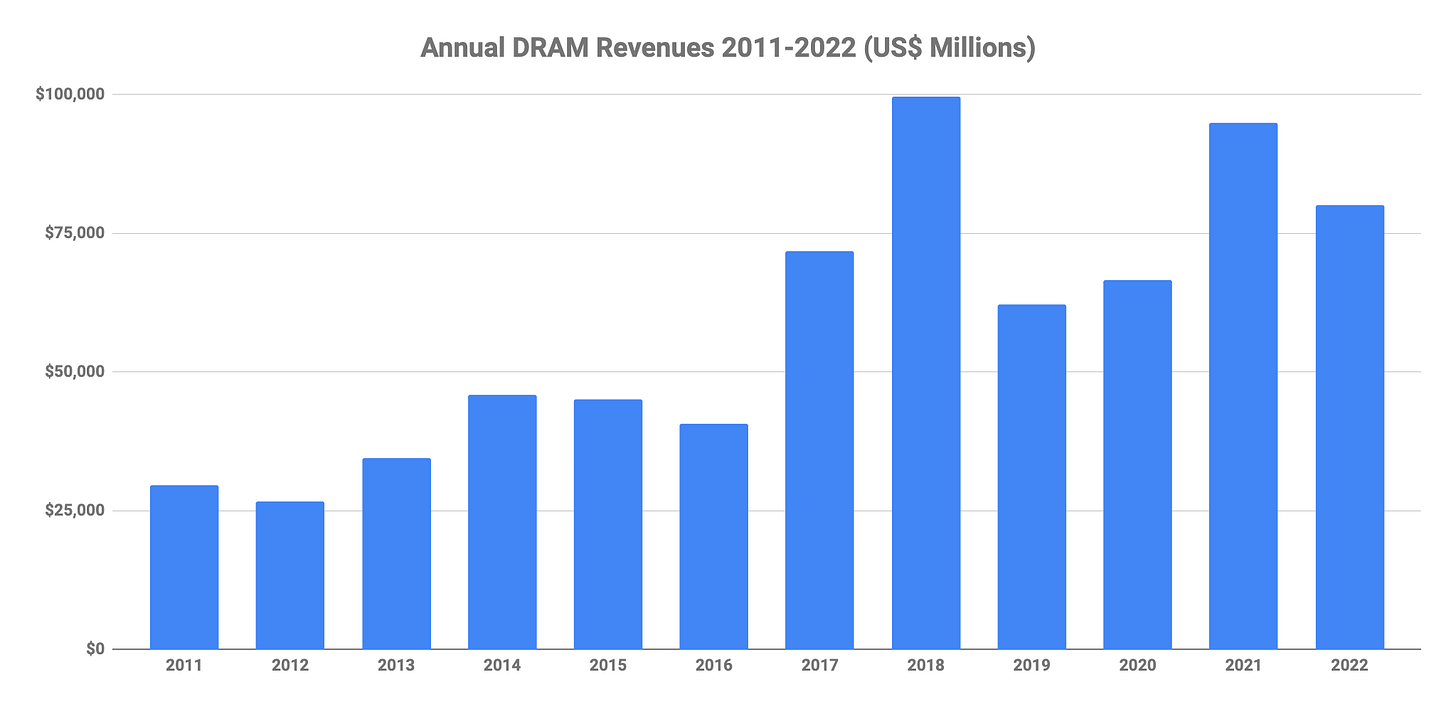

It was a similar story with DRAM last year. After starting out with two quarters of near all time record revenues, there were sequential declines of around 30% in each of the last two quarters. For the year as a whole, revenues declined by 15.6% to just over $80 billion.

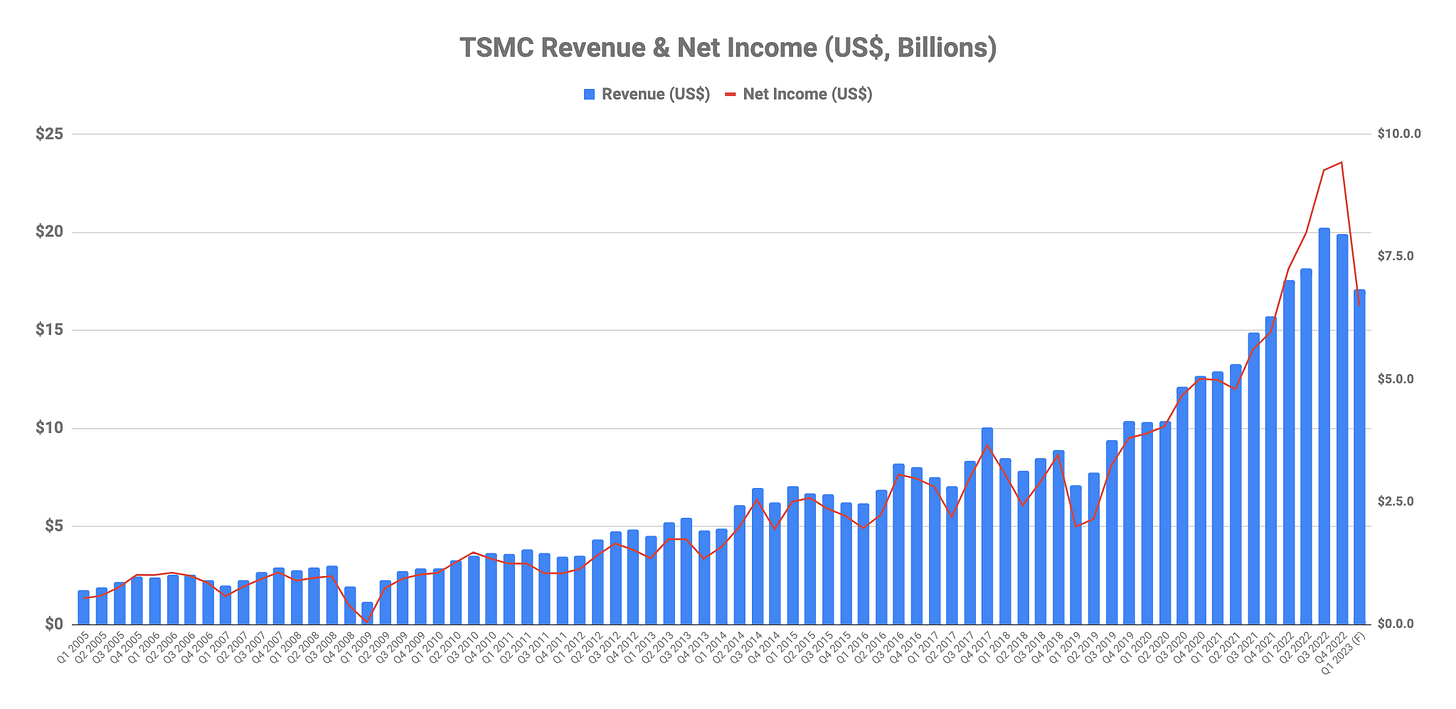

TSMC recorded one of its strongest ever growth years in 2022 with revenues growing by 33.5% to reach an all time record high of $75.88 billion.

Intel Full-year 2022 revenue was $63.1 billion, down 20% YoY and 17% lower than the full year guidance issued in February 2022. This was in sharp contrast with AMD which recorded revenues of $23.6 billion, up 44% YoY driven by higher Embedded, Data Center, and Gaming segment revenue, partially offset by lower Client segment revenue. On a combined AMD and Xilinx company basis, 2022 pro forma revenue was $24.1 billion, up 20% compared to $20.1 billion in 2021.

2023 Outlook

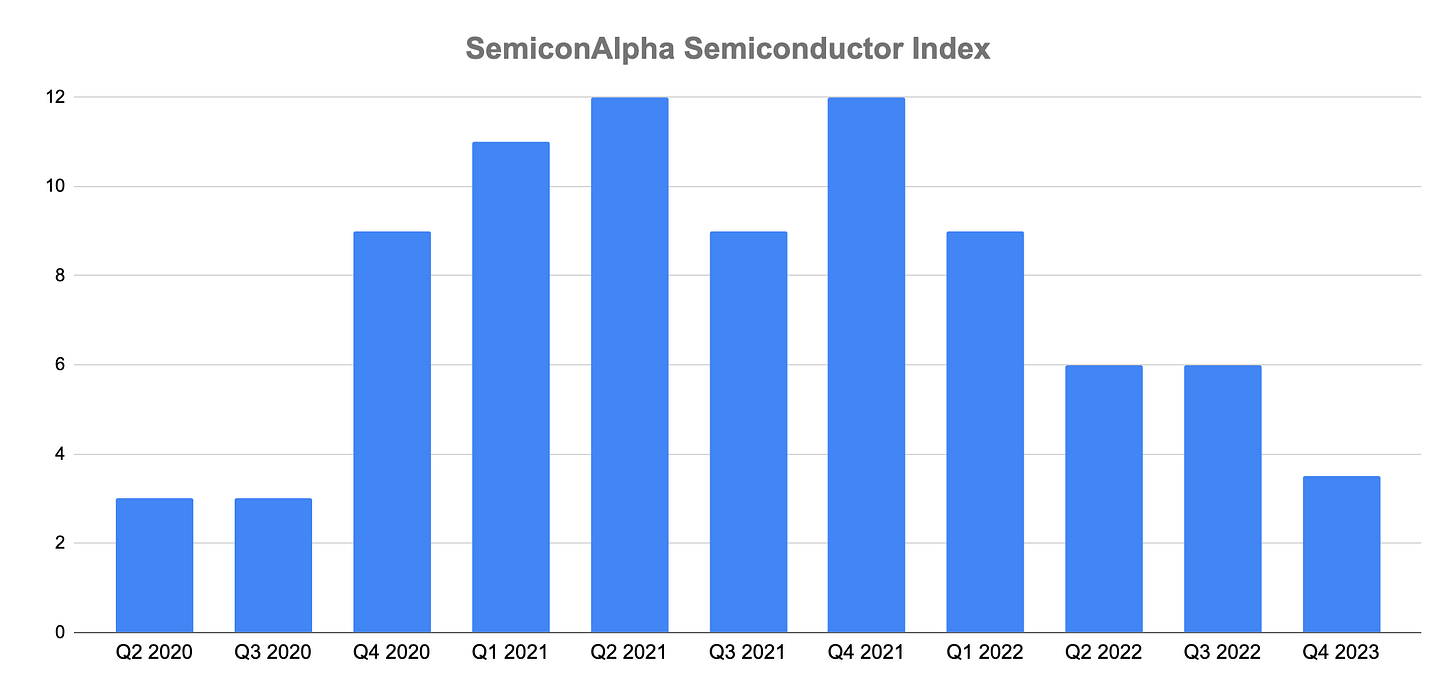

Before getting into the detail of our 2023 outlook, I’d like to first introduce our set of twelve proprietary indicators. These indicators are a combination of leading and lagging metrics, some measured monthly, some quarterly. Together they reflect the current state of the broader semiconductor industry and can help us understand its likely trajectory in the coming months and quarters.

We began using this indicator set back in Q2 2020, right at the middle of the last significant downturn in the semi industry.

Notes:

#1 the maximum score is 12, representing a semiconductor industry firing on all cylinders. The lower the score, the deeper the downturn being experienced.

#2 the index can be thought of either in the aggregate or by viewing the constituent indicators individually. Certain indicators are fine tuned for specific segments of the industry.

So what are the specific indicators that make up our Semiconductor Index? Before we get into the detail, spoiler alert! Two of these indicators are flashing strong red signals which tell us the following:

#1 The server segment is experiencing a roughly 50% slow down compared the the unit shipment run rate experienced through most of 2022

#2 The DRAM segment continued to deteriorate through January and February this year. In other words, there’s no evidence yet of any trough or stabilisation in DRAM.

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.