Silicon Wafers Q324 Area Shipments, Revenue, EBIT, Outlook & More

gross margins still under pressure across the board

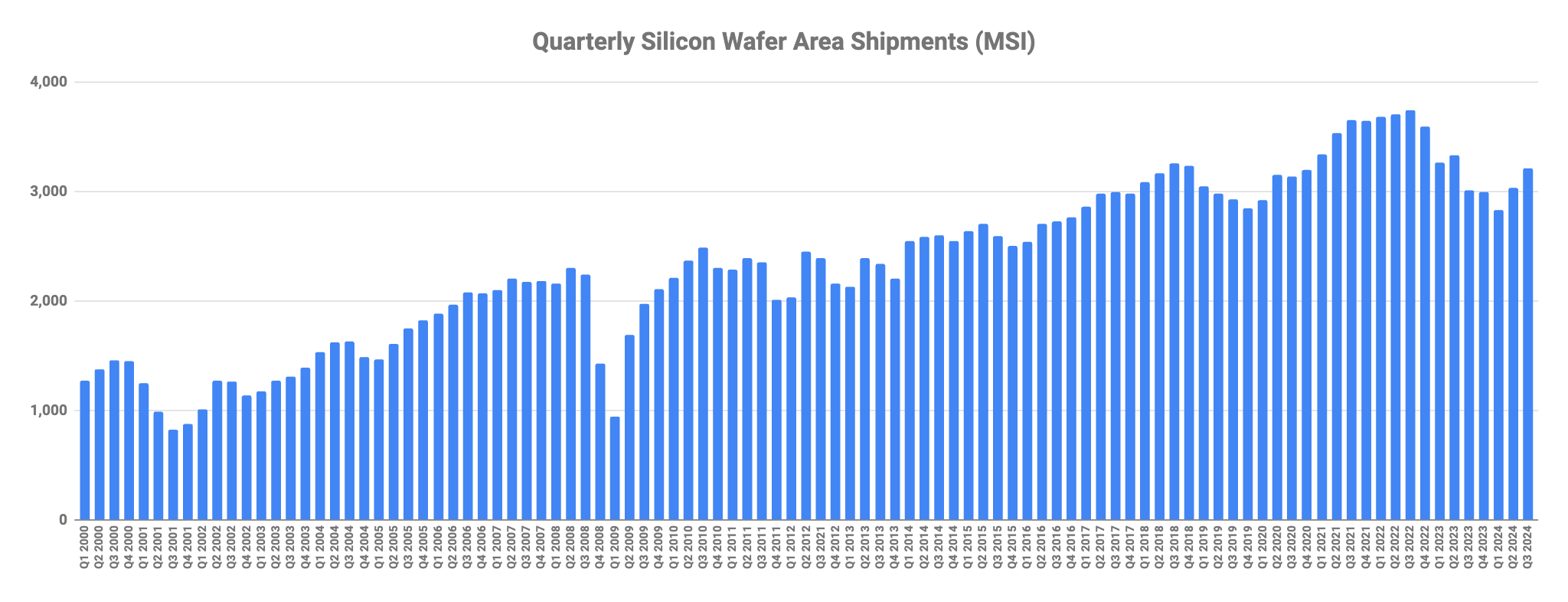

Silicon wafer area shipments in Q324 amounted to 3,214 million square inches (MSI), up 5.9% QoQ and up 6.8% YoY, details here. This marked the sector’s second consecutive quarter of sequential growth in area shipments.

It was also the first quarter of YoY growth since Q322, exactly two years ago.

According to SEMI:

The third quarter wafer shipment results continued the upward trend which started in the second quarter of this year. Inventory levels have declined throughout the supply chain but generally remain high. Demand for advanced wafers used for AI continues to be strong. However, the silicon wafer demand for automotive and industrial uses continues to be muted, while the demand for silicon used for handset and other consumer products has seen some areas of improvement. As a result, 2025 is likely to continue upward trends, but total shipments are not yet expected to return to the peak levels of 2022.

While the silicon wafer area shipment growth rate over the past two quarters is a positive development for the beleaguered segment, it does little to improve the bottom line for the key players still struggling with increasing electricity prices, low utilization rates and soaring depreciation costs. Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.