UMC. Calling Q1'23 The Trough Despite Limited Forward Visibility

Their Q2'23 guidance is better than TSMC's. But why?

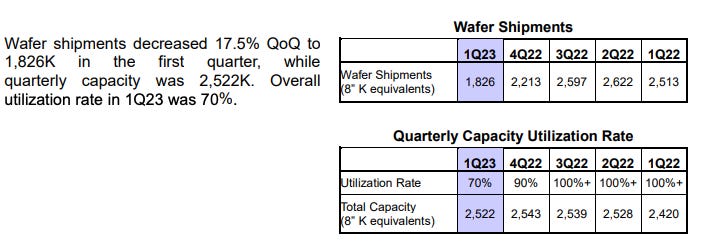

Taiwan’s UMC, the world’s third largest foundry, yesterday reported Q1’23 revenues of NT$54.2 billion, a decrease of 20.1% QoQ and a 14.5% YoY. According to Jason Wang, co-president of UMC, wafer shipments fell 17.5% QoQ, as had previously been forecasted:

“In the first quarter of 2023, our business was impacted by sluggish wafer demand as customers continued to digest elevated inventory levels. In line with guidance previously provided, wafer shipments fell 17.5% QoQ and utilisation rate dropped to 70%, while average selling price stayed firm during the quarter.

Despite lower utilization, gross margin remained firm at 35.5%, reflecting improved structural profitability and optimized product mix. Although demand weakened across major end markets, our automotive and industrial segments posted growth during the quarter.

Automotive sales, in particular, accounted for 17% of overall first quarter revenue. While this partially reflects declines in other segments, we expect automotive to remain a significant revenue contributor and key growth driver for UMC going forward, as IC content in cars continue to increase driven by electrification and autonomous driving.”

In terms of the Q2’23 outlook, Wang made the following comments in the prepared remarks:

Entering the second quarter of 2023, we expect customers’ inventory correction to linger given the softness in overall end market demand. As a result, our wafer shipment will be flat this quarter.

Note that UMC’s capacity utilisation will improve modestly from 70% in Q1 to the “low-70%” range in Q2.

This positive outlook was in contrast with TSMC’s Q2’23 forecast for a QoQ sequential decline of 6.5% as we discussed here:

While some had surmised that the first quarter might be the trough for TSMC, this was not to be the case and the company pegged current quarter revenues at $15.6 billion at the midpoint, down a further 6.5% sequentially.

So why is UMC anticipating a better second quarter compared to TSMC? After all, both companies operate in the same business the primary difference being one of scale. Furthermore, while we were initially enthused by UMC’s earnings report, that slowly began to fade as we read through the detail of their earnings call transcript. What did we find there that curbed our enthusiasm? Let’s dig in …

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.