UMC. This Is Interesting...

the stock is at a four year low, but the company has invested heavily into the downturn

UMC reported Q424 revenues of NT$60,386 million, flat sequentially and in line with guidance. Gross profit of NT$18,343 million resulted in a gross margin of 30.4%, down 3.4 points sequentially but again in line with prior guidance. For the full year 2024, revenues amounted to NT$232,303 million, representing an increase of 4.4% YoY.

Utilization in Q424 was 70%, down one point sequentially, but up five points from the year ago period.

Looking ahead, the company guided Q125 down in the mid-single digit percentage range, despite wafer shipments remaining sequentially flat.

The sequential decline is due to the company’s recently adopted strategy of offering price cuts at the beginning of each year, a gambit designed to deal with the ever increasing competition in the mature foundry market, primarily from China.

Beyond the first quarter, UMC declined to issue further guidance, noting that visibility thereafter was poor. However, co-chairperson Jason Wang did imply that 2025 would be a year of modest growth for the company, most likely in the mid-to-high single digits range.

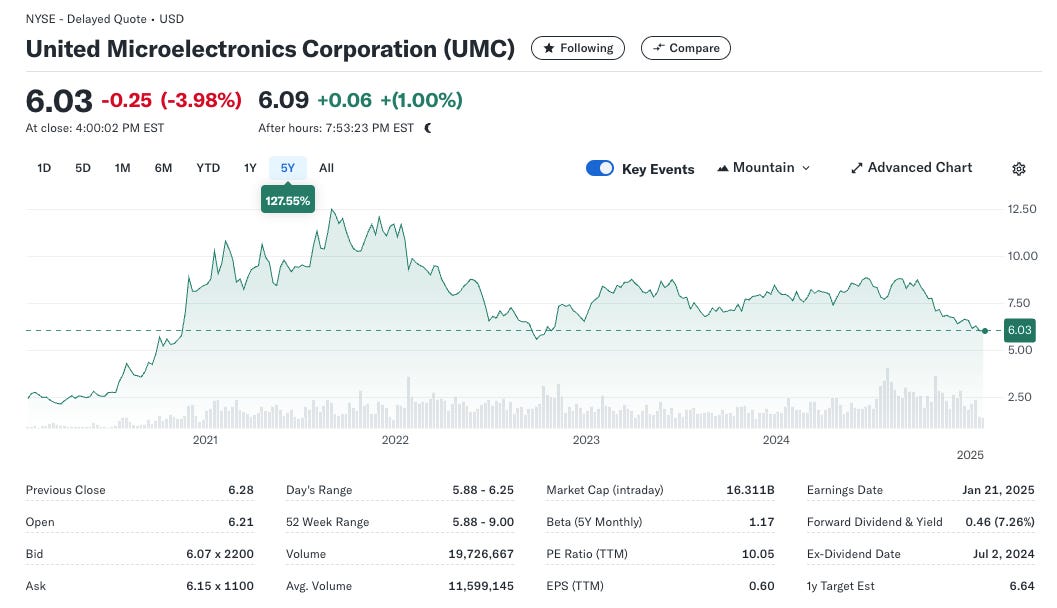

In summary, it wasn’t a particularly inspiring report or outlook, basically just more of the same as saw last year, and the year prior to that. As a result, the ADR share price fell by ~4% on US markets overnight.

At its current level, UMC’s share price of ~$6 is down ~33% from its 52 week high, and down ~50% from its five year high established during the pandemic-driven upturn in late 2021.

On the surface, there’s not a lot to entice investors to get on board at this juncture, but, if you look a little closer, you might start to like what you see. Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.