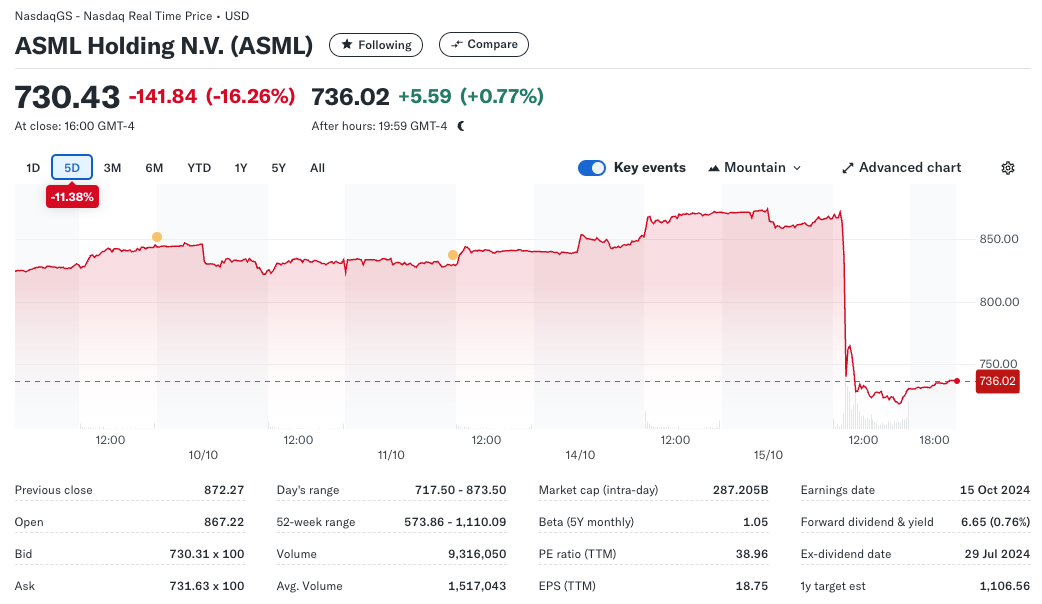

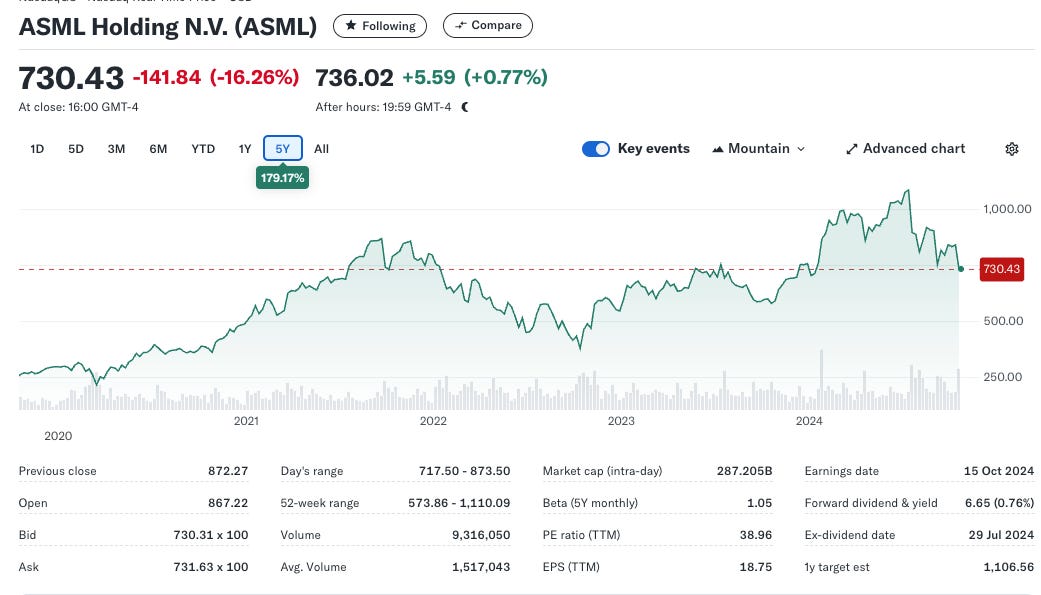

ASML is scheduled to report their third quarter earnings today, Wednesday October 16. Imagine my surprise this morning to see my inbox already flooded with emails detailing ASML’s results. Apparently, those results were “inadvertently” posted on ASML’s website overnight in advance of today’s earnings call. To make matters worse, those results included a distinctly downbeat note as far as the company’s outlook for 2025 is concerned. This triggered an immediate 16% crash in ASML’s share price…

Combined with the gradual decline in the share price that’s been happening since mid summer, it means that ASML is presently trading at the same price it was at back in late 2021

As if this wasn’t bad enough, ASML’s news also tanked a whole host of other semi stocks overnight with KLAC being the worst impacted.

Bizarrely, exactly one year ago, ASML had an almost identical, albeit slightly less damaging, impact on the broader semiconductor market when they flagged for the first time that their 2024 revenue outlook was for zero growth year on year. We discussed this development in detail here:

Our conclusion in that note was the following:

As far as the broader semiconductor industry is concerned, ASML’s latest results reinforces the fact that there are ongoing inventory-related challenges, the memory segment remains in the doldrums and growth in key sectors such as smartphone and PC remains anemic. There’s no V-shaped recovery on the horizon. It’s going to be a long, slow grind to get back to robust growth levels. Let’s see how the remainder of the earnings season pans out….

Moving back to the present day, ASML’s bad news wasn’t just limited to their 2025 outlook. What’s going on? Let’s dig in…

Keep reading with a 7-day free trial

Subscribe to Semicon Alpha to keep reading this post and get 7 days of free access to the full post archives.